- Dance to your own music and take some risks in life, because it is often the risk taker who changes the course of history and contributes to the well-being of millions of lives.

- At SFO we have always pioneered to change the history of humans and hence Market Economy, Progress, Growth, Development, (MEPGD) has always been a way of life in SFO.

- Because human history changes when the quality of life of people changes.

- And so far GDP ( at household level or state level or national level or continent level or world level ) has been the biggest GROWTH ENGINE for uplifting human life.

- TRUTH is that GDP grows by way of creation of capital assets.

- When it comes to creating capital assets we don’t shy of creating capital assets as GROWTH ENGINES.

- Our new GROWTH ENGINE is COMPOSITES.

- Composites are projected to replace the 2.5 Tn metals market.

- Composites are also projected to replace the 0.5 Tn woods market.

- We invite supply chain partners for our New Growth Engine.

- Together we can build back better. Stay safe and stay healthy.

The Global Composites Market Overview

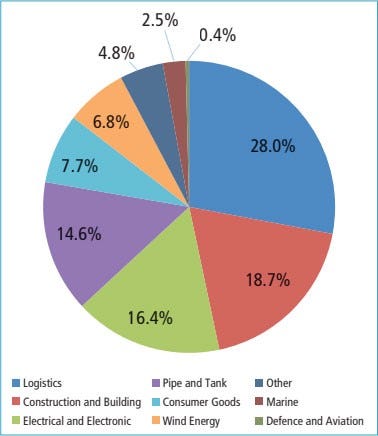

The global Composites market size is expected to gain market growth in the forecast period of 2020 to 2025, with a CAGR of 4.8% and will expected reach USD 200 Bn by 2025, from USD 115 Bn in 2019.

- In 2019, the volume of the global composites market reached 11.8 million tons valued at 115 Bn USD.

- The market volume, is expected to reach 15.9 million tons by 2025 valued at 200 Bn USD.

- The average year-on-year volume growth rate throughout the period between 2019 and 2025 is expected to be roughly 4.8 percent.

The Indian Composites Market Overview - Government plans to develop a furniture cluster

- Furniture making is one area where the government is aiming to kill many birds with single stone. Under the ‘Atmanirbhar Bharat Mission’, the government is working to develop a furniture cluster near a port where common facilities for testing, research, design and packaging can be provided. Such a cluster would help furniture manufacturing on a large scale to meet domestic requirements and push India into the global furniture trade market.

- The government is also planning to tighten the restrictions for the import of furniture into the country as part of its Aatmnirbharata (self-reliance) policy. This move will not only save foreign currency but also will boost the domestic industry and generate employment as furniture and wood panel industry are labour intensive. According to available data, India’s annual imports of wood and allied products amounted to Rs 15,000-20,000 crore while furniture or wood panel are not technology intensive products. Moreover, several countries are considering reducing dependence on China, which could benefit India’s wood panel industry, especially in MDF exports.

- Further, global trade in furniture is about Rs 20 trillion and India is not a key player in this segment despite having cheap labour in abundance. Further, the government is working on the possibility of importing wood in India without any duty, which would help solve the issue of availability and boost the domestic furniture manufacturing industry.

- The size of the organized furniture market in India is about Rs 25,000 crore, while the overall furniture market size in India about Rs 2 trillion. Furniture imports from China into India are currently estimated at US$2 billion. With anti-Chinese sentiment prevailing in the country now, the wood panel industry and the furniture makers in India expect a big opportunity for Indian modular furniture makers in replacing these Chinese imports over medium to long term. According to them, there is likelihood of an increasing acceptance of ready-made furniture or modular furniture in India which would also drive higher demand.

The Composites World

- The manufacturing world likes to think of composites fabrication as a single, global entity that operates to serve its customers’ needs with a variety of highly engineered parts and structures. In reality, however, the composites industry is an amalgamation of many highly vertical markets — aerospace, automotive, marine, consumer, wind, etc. — that consume composite materials in a variety of different ways. This usage is driven by part performance requirements, cost thresholds, regulations and customer demand. For instance, the material, process and cost parameters in commercial aerospace manufacturing are substantially different than the material, process and cost parameters in recreational boatbuilding.

- Composite materials can meet such diverse needs because they are so diverse themselves. The array of fiber, resin, tooling, process and finishing options available make possible the fabrication of nearly any composite part for nearly any application. Couple this with the tremendous strength, stiffness, durability and light weight attributes that composites offer and it’s not hard to understand why use of these materials is growing as much as it is.

- The highly bespoke nature of composites not withstanding, there are some broad materials and process trends shaping the entire composites industry that bear watching over the next several years. First among these is the effort to get touch labor out of the manufacturing process by increasing use of robotics and automation. This is driven by several things, including a desire to increase consistency and quality, a desire to reduce costs, and a demand for higher volume manufacturing.

- Second is the effort to get out of the autoclave. As wonderful as the autoclave is at consolidating composite laminates, it is expensive to acquire and operate. It also can be a production bottleneck that hinders the drive toward higher volume throughput. As a result, out-of-autoclave (OOA) materials and processes — resin infusion, resin transfer molding (RTM) and thermoplastic composites — are being considered more seriously in a range of applications, not the least of which are large commercial aerospace structures.

- Third, thermoplastics in general are on the rise, primarily because of the attributes they offer, including OOA processing, easy storage and handling (compared to prepregs) and easy recycling.

- Fourth is the advent of Composites 4.0, the composites industry’s version of Industry 4.0 — the complete digitization of the manufacturing process, from design to simulation to manufacturing simulation to manufacturing to troubleshooting to part tracking and much more. This is leading to development and use of complex algorithms that will govern thinking machines in the next-generation composites manufacturing environment.

- Fifth is the massive expansion of additive manufacturing (AM) in composites fabrication. The initial use of chopped fiber reinforcements in thermoplastic-based AM has led to the use of continuous fiber reinforcements to make discrete parts as well as tooling and mold components. The industry has also seen the advent of thermoset-based AM as well as new processes that combine AM with automated fiber and tape placement.

- All of these technologies spring from and help drive a highly dynamic and fast-changing composites industry, and in the Multitude of Markets that follow. Here we shall see how composites materials and processes are being adapted and applied in each of the major end markets served by composites designers and fabricators. We will also see how macro trends in each end market affect the composites manufacturing community.

Aerospace

- Aerospace composites: Some of the newest aerocomposites manufacturing technologies are being deployed in the manufacture of the wings for the Boeing 777X. The wingspan of the plane is 235 ft (72m) and the wings are being fabricated with autoclave-cured carbon fiber prepreg at a Boeing facility in Everett, Wash., U.S. The plane is expected to enter service in 2020.

- In 2019, the global commercial aerospace industry was shaped and dominated by the grounding of the Boeing 737 MAX, which was precipitated by the crash of two 737 MAX aircraft, one in late 2018 and the other in early 2019. The cause of the crashes, which killed more than 300 people, was an automated flight control system Boeing developed specifically for the 737 MAX. Boeing has committed significant resources to correcting the automated flight control system, but as of this writing in early Novembermid-October 2019, the plane was not expected to return to service until late 2019 or early 2020. In the meantime, Boeing continues to assemble 737 MAX aircraft, but is not delivering these until the fix is done, proven and certified.

- The grounding of the plane has had significant ripple effects throughout the aerospace industry supply chain, with some consequence to the composites industry as well. In particular, Boeing has had on the drawing board for some time the New Midsize Aircraft (NMA), a twin-engine, twin-aisle, mid-range plane that would fit between the 737 and the 787 in terms of size and range and would serve a segment that used to be occupied by the discontinued 757. Initial speculation said Boeing would announce the NMA at the 2019 Paris Air Show, with entry into service around 2025. However, the 737 MAX grounding apparently has not allowed the company to devote significant resources to a new program launch, plus Boeing experienced problems with the engine on the 777X and delayed first flight of this craft (with all-composite wings) to early 2020. All of this added up to no NMA announcement in Paris.

- The NMA program is also complicated by Airbus, which announced at the 2019 Paris Air Show the A321XLR, an extended version of the single-aisle A320. It will seat 240 people and have a range of 4700 nautical miles. This makes the A321XLR competitive with the NMA, for which Boeing is contemplating two versions: One that seats 225 with a 5,000-nautical-mile range and another that seats 275 with a 4,500-nautical-mile range. If Boeing announces the NMA soon after the 737 MAX returns to service, and assuming both of these things happen by mid-2020, then prospective customers would have a choice of two aircraft that offer similar passenger and range options, with comparable efficiency, with one a single-aisle and the other a double-aisle configuration.

- The NMA is significant because it represents the next all-new aircraft program on the horizon, and, like the Boeing 787 and 777X, and the Airbus A350, it is expected to feature major structures fabricated with carbon fiber composites. In addition, beyond the NMA, just over the horizon, are expected single-aisle replacements for the Boeing 737 and the Airbus A320. Both of these aircraft are ripe for conversion to carbon fiber composites and would represent a major leap forward in composites manufacturing throughput — Boeing and Airbus both anticipate single-aisle replacement build rates of 100 shipsets per month. These programs could, if announced in the next couple of years, enter service in the 2028–2030 window.

- The 737 MAX grounding, however, has thrown some uncertainty into this timeline. That is, Boeing could decide that a 737 replacement should be accelerated, and launch its development sooner than planned. Such a decision could, consequently, prompt Airbus to move up its A320 replacement, which is likely that company’s next all-new aircraft. In short, as long as the 737 MAX is grounded, there is much uncertainty in the commercial aerospace supply chain in general, and the aerocomposites supply chain in particular.

- Setting aside the issue of which aircraft programs might be announced when, there are substantive and unanswered questions surrounding the NMA and single-aisle replacements. The overarching question is if and where composites will be used on these planes. For the twin-aisle NMA, use of composites is almost certain, particularly given the supply chain and manufacturing processes in place for the 787, 777X, and the A350. Also important is the fact that the air carriers themselves prefer the durability and ease of maintenance of composite structures compared to traditional aluminum structures — this fact in and of itself might be enough to compel continued use of composite materials in large aerostructures, regardless of size or configuration.

- Assuming that carbon fiber composites use in large aerostructures will continue, the next question is what type of materials those will be. The incumbent material and process (M&P) combination is autoclave-cured carbon fiber/epoxy prepreg, laid down for the most part via automated tape laying (ATL), automated fiber placement (AFP) or by hand. However, the M&P combinations qualified for the 787 and the A350 in particular are relatively old, having been developed in the early 2000s.

- Still, the fact that these M&Ps are qualified gives them a leg up against newer M&Ps, which are still being developed and qualified. And for the NMA, for which Boeing likely does not want to develop significant and new M&Ps, the incumbent technology likely wins out. Further, the build rate of the NMA is likely to be similar to the build rate of the 787 (124/month) and the A350 (10/month);, thus there is less pressure by Boeing to develop and qualify faster-cycling M&P technologies.

- All of these assumptions, however, go out the window with the single-aisle replacements that will follow the NMA. Boeing’s and Airbus’s current single-aisle aircraft, the 737 and the A320, are the aerospace industry’s best and most profitable sellers and most profitable. Manufacture of composite parts and structures for these planes at the anticipated rate of 100/month is not feasible using current autoclave cure technology. Because of this, the new single-aisle planes in development will almost certainly employ out-of-autoclave (OOA) materials and processes that deliver dramatically shorter part cycle times.

- This has thrust to the fore several OOA technologies that are almost certain to be deployed extensively in next-generation aircraft. These technologies include thermoplastic composites, resin infusion and resin transfer molding (RTM). Boeing and Airbus each are pursuing these technologies through a variety of research and development programs designed to bring maturity to a technology readiness level (TRL) that allows commercial deployment by 2025 at the latest.

- Airbus, for its part, is pursuing a variety of solutions through multi-company, high-profile programs. Most notable is the Wing of Tomorrow Programme, being led by GKN Aerospace (Shirley, Solihull, U.K.), with the National Composites Centre (NCC, Bristol, U.K.), Northrop Grumman (Clearfield, Utah, U.K.), Spirit AeroSystems (Wichita, Kan., U.S.) and Solvay Composite Materials (Alpharetta, Ga., U.S.). This program is assessing use of RTM to fabricate wing skins, wing spars, ribs, and wing box. GKN announced at the 2019 Paris Air Show that it had produced demonstrator parts for Wing of Tomorrow, followed in October by the news that it had delivered a demonstrator tool.

- The Wing of Tomorrow’s goal is to develop a very high-rate commercial aircraft wing structure manufacturing process that is, in nearly every measurable way, an order of magnitude better than current wing manufacturing technology. This means better automation, fewer parts, better parts integration, faster cycle time, faster NDI and faster assembly. Testing of a full wing is expected to begin in 2021.

- Infusion of wing structures is not novel. Two commercial aircraft already use the process: The Airbus A220 and the Irkut MC-21, both single-aisle aircraft. The A220 was developed by Bombardier as the CSeries and then sold to Airbus in 2018. Its infused wings are still fabricated by Bombardier at its Belfast, Northern Ireland, facility, which Bombardier put up for sale in 2019 (Spirit AeroSystems announced in October 2019 that is acquiring Bombardier’s Belfast operations). The Irkut MC-21 is being manufactured by United Aircraft Corp. (Moscow, Russia) for the Russian market. Its wings are fabricated by AeroComposit (Moscow) using a Solvay Composite Materials single-component resin system. What the A220 and the MC-21 prove is that infusion is feasible for commercial aircraft, but the rate on both of these planes is relatively low. The technology must now be matured for a high-rate environment.

- Thermoplastic composites, for their part, are being targeted toward fuselage structures. This is important because for many years it was unknown if composite materials made sense for use in the fuselage of a single-aisle aircraft, primarily because fuselage skin thickness on a single-aisle is thinner than that on a twin-aisle aircraft. That thinner skin, using incumbent composite materials and processes, makes composites cost- and weight-prohibitive. The challenge, then, is to develop a composites M&P combination for the fuselage that provides relatively thin and affordable skin thickness.

- In Europe, this effort is being funneled through the Clean Sky 2 Next Generation Multifunctional Fuselage Demonstration (MFFD) project. As the name implies, the program aims to increase integration of fuselage, systems, cargo and cabin elements, in the process minimizing the use of fasteners. Use of thermoplastics would allow this via welding. One of the most active companies in the development of thermoplastic aerostructures is GKN/Fokker (Hoogeveen, Netherlands), which at JEC World 2019 in Paris exhibited a thermoplastic fuselage panel fabricated for Gulfstream. It features an interconnected, welded grid structure that exemplifies the multifunctionalism envisioned by Clean Sky’s MFFD. The Fokker structure represents a small step of many to come in the maturation of this technology for potential use in a single-aisle commercial aircraft.

- Beyond the fuselage, thermoplastic composites are already making significant inroads with aircraft already in service. Boeing in particular is in the midst of a concerted effort to convert smaller structural parts (brackets, clips, fasteners) from thermoset to thermoplastic composites. Thermoplastics specialists like ATC Manufacturing (Post Falls, Idaho, U.S.), which specializes in continuous compress molding, are leading this conversion effort.

- Activity is also significant on the raw materials side of thermoplastics. Resin manufacturer Victrex Plc (Cleveleys, U.K.) made waves in the composites industry with the introduction of PAEK AE 250, a line of carbon fiber tapes and laminates prepregged with its low-melt polyaryletherketone (PAEK) resin. PAEK offers a melt temperature of just 305°C — compared to 350° for polyetheretherketone (PEEK), a mainstay in thermoplastic aerocomposites. This is important because reduced melt temperature speeds the heating/cooling cycle and allows for fast cycle times. It also enables overmolding of PEEK functionality (ribs, attachment clips) onto PAEK laminates.

- Anticipating increased demand for thermoplastics in aerocomposites, Solvay Composite Materials announced in September 2019 that it is expanding production capacity at its Anaheim, Calif., U.S. facility. The plant makes unidirectiitonal (UD) carbon fiber tapes prepregged with PEEK, PEKK or PAEK resins. The expansion, combined with ongoing process optimization efforts, will increase capacity at the facility fourfold since 2016.

- Also on the fuselage front, but back in the thermoset realm, Spirit AeroSystems introduced at the Paris Air Show 2019 its newly developed Advanced Structures Technology and Revolutionary Architecture (ASTRA) fuselage panel for a single-aisle aircraft. It’s autoclave cured using a new fuselage design Spirit developed called “sheet stringer technology.” The company says ASTRA offers cost savings of 30% compared to incumbent architectures and production approaches and can meet a rate of 60 shipsets/month. Further, physical testing showed that ASTRA met all of the strength and stiffness requirements of a single-aisle aircraft.

- Similar to Spirit, although on a smaller scale, was MTorres (Torres de Elorz, Navarra, Spain), which exhibited at the Paris Air Show a rib-stiffened “grid/skin structure,” manufactured via resin infusion of dry carbon fibers. The idea came from Stephen Tsai, composites veteran and professor of aeronautics and astronautics, emeritus, at Stanford University, who designed the ribs in a lattice structure, with each rib a fixed width and height, and spacing between ribs also fixed. The rib architecture uses carbon fiber tapes placed continuously, by MTorres AFP equipment, in one direction (A), and discontinuously in the intersecting direction (B). Then, for the next layer, tapes are placed discontinuously in the A direction and continuously in the B direction. This pattern would continue until the rib’s desired thickness is reached. In this way, each rib joint would always be crossed by a continuous tape. Once the ribs are built in the tool, a skin is laid over it via automated AFP/ATL and the entire structure is co-cured.

- Use of resin transfer molding, infusion, thermoplastics and additive manufacturing in next-generation commercial aerospace structures is being explored.

- The carbon fiber supply chain, meanwhile, has been busy positioning new and existing fibers for next-generation aerospace applications. Toray (Tokyo, Japan), the world’s largest carbon fiber manufacturer, introduced in 2017 its T1100/3960 prepreg, which offers excellent strength and stiffness properties. T110/3960 has been qualified by Spirit AeroSystems. Hexcel (Stamford, Conn., U.S.), for its part, has introduced HexTow HM50, a high-modulus and high-tensile strength carbon fiber. Teijin (Tokyo, Japan), announced in January 2019 that its Tenax carbon fiber and carbon fiber thermoplastic unidirectional pre-impregnated tape (Tenax TPUD) have been qualified by Boeing and registered in its qualified products list. Finally, Hyosung (Seoul, South Korea), in late 2018, introduced a new intermediate modulus, high-strength carbon fiber for the aerospace market, and in June 2019 signed a memorandum of understanding with Saudi Aramco (Dhahran, Saudi Arabia) for the building of a joint carbon fiber manufacturing facility.

- All of this activity, positioning and jockeying of the aerospace supply chain anticipates substantial growth in the commercial air travel market over the next 20 years. Boeing, in June 2019, issued its Commercial Market Outlook 2019–2038. In it, the company estimates that the world will need, over the next two decades, 32,420 single-aisle aircraft, 8,340 twin-aisle aircraft, 2,240 regional jets and 1,040 freighters. Airbus issued its own Global Market Forecast 2019–2038. It divides aircraft into small, medium and large categories, but reaches a conclusion similar to Boeing’s. Airbus anticipates need for 29,724 new small aircraft, 5,373 new medium aircraft and 4,116 new large aircraft, with freight units comprising 855 planes total in the medium and large categories.

- Occupying a small corner of the global commercial air travel market are supersonic aircraft, which have not been in service since the Concorde was retired in 2003. There are several firms now pursuing new supersonic aircraft, and one of the most prominent is Boom Aerospace (Englewood, Colo., U.S.), which is developing the composites-intensive Overture. Boom CEO and founder Blake Scholl, at the Paris Air Show, said that Boom is nearing completion of the XB-1, a subscale prototype of the Overture that is expected to be rolled out by the end of 2019 and test flown sometime in 2020. Overture will have a maximum speed of Mach 2.2, a cruising altitude of 60,000 feet (19,354 meters) and will take passengers (55–75) from Sydney to Los Angeles in just 7 hours, or Washington D.C. to London in just 3.5 hours. Scholl stated that ticket cost on Overture is expected to be competitive, on a seat-per-mile basis, with current airline pricing. Scholl also said that Overture is expected to use a technology called Prometheus Fuels, which converts atmosphere carbon into gasoline or, in Boom’s case, jet fuel, using electricity sourced from renewable resources. In this way, he said, the plane will provide zero net carbon supersonic flight.

- 2019 also saw a small but growing aerospace segment begin to take shape. It’s most broadly called urban air mobility (UAM) and includes a variety of small craft (4–10 passengers) designed to move people in intra and inter-city environments. Aircraft range varies, depending on the size of the craft and its propulsion system, but the goal is to be able to move a few people from one point to another within a major urban area, or from one urban area to another. Uber, which is working on its own eVTOL, requires a range of 60 miles on a charge. Regardless of the range requirements, composites use in eVTOLs is a must, particularly given the dependence on battery power. Because of this, several eVTOL developers (and there are more than 150) are investing heavily in composites engineering talent. The challenge is that the eVTOL market will likely have certification standards as stringent as the commercial aerospace market, but also will require much higher manufacturing volumes that step toward those in automotive. This is driving increased interest in automation and efficiency in composites fabrication processes to drive down cost, boost quality and meet rate. The high level of activity in this market not withstanding, there is still much to be done before eVTOLs begin commercial service. Certification, airspace management, safety standards, take-off/landing locations, and more are yet to be worked out. Commercial service of the first eVTOLs likely will not begin until 2024–2025.

- Another craft within the UAM sector that is set to consume composite materials (for the same reason) is the all-electric commercial airplane. An example of this, introduced at the Paris Air Show 2019, is the Alice, an all-electric, all-composite aircraft developed by Eviation (Kadima-Tzoran, Israel). Alice is a nine-seat regional transport aircraft that has a range of 650 miles/1,000 kilometers at a cruising speed of 240 knots. The plane features one primary pusher propeller at the tail and two additional pusher propellers at the wing tips. The company expects the plane, which has a list price of $4 million, will be certified in late 2020 or early 2021.

- The advent of Eviation’s Alice portends an emerging future for commercial air transport — that of all-electric regional transport. Although the Alice seats only nine passengers, it’s not difficult to imagine the technology behind it evolving to allow a larger craft that can carry more people and fly further — similar to today’s regional jets. As if to prove the point, Boeing and engine-maker Safran announced in September 2019 a joint investment in Electric Power Systems(EPS, Hyde Park, Utah, U.S.), which manufactures electric and hybrid-electric energy storage systems. These would be applied to aircraft propulsion. EPS is the second advanced battery solutions company to join the Boeing HorizonX Ventures investment portfolio, following an investment in Cuberg (Emeryville, Calif., U.S.), a lithium metal battery technology company, in 2018. Safran Ventures also recently invested in OXIS Energy (Abingdon, U.K.), a leader in lithium-sulfur cell technology for high energy density battery systems.

- Airbus, for its part, is developing the E-Fan X, a hybrid-electric aircraft demonstrator. In the test aircraft, one of the four jet engines will be replaced by a 2-megawatt electric motor. The electric propulsion unit is powered by a power-generation system and battery. When high power is required — at take-off, for example — the generator and battery supply energy together. The E-Fan X is expected to make its first flight in 2021.

Automotive

- Automotive composites: Pultruded profiles serve as the load-carrying skeleton for the overmolded, fiber-reinforced PA6 muscle of this next-generation windshield frame that outperforms the current BMW i3 structure. Source | SGL Carbon

The automotive industry continues to develop composites for lightweighting vehicles, driven by fuel economy and emissions regulations:

- Current U.S. corporate average fuel economy (CAFE) standards mandate a fleet average of 54.5 mpg (23.2 km/L) by 2025. (Note: President Trump has proposed scaling back these standards, but as of early November 2019, that scale-back had not been implemented.)

- China’s Corporate Average Fuel Consumption (CAFC) sets a fleet target of 20 km/L by 2020; and

- EU emissions regulations mandate a mere 95 g/km of CO2 by 2021, with another 15% reduction by 2025, and in 2030, a further 30% reduction from 2021.

The market for carbon fiber in automotive applications was estimated at more than 7,000 metric tons (MT) per year by Chris Red of Composites Forecasts and Consulting LLC (Mesa, Ariz., U.S.) at CW’s Carbon Fiber 2017 conference, with more than 100 models currently specifying carbon fiber-reinforced plastic (CFRP) for OEM components. He projects this market will grow to almost 11,000 metric tonnes by 2025.

China is the number one automotive market, producing 27.8 million vehicles in 2018, which includes all passenger cars, light commercial vehicles, trucks, buses and coaches. This is compared to:

- 11.3 million vehicles in the U.S.

- 9.7 million vehicles in Japan

- 5.2 million vehicles in India

- 5.1 million vehicles in Germany

- 4.1 million vehicles in Mexico

- 4.0 million vehicles in South Korea.

Thus, it isn’t surprising that development of composite structures used in actual series production vehicles — not just high-end options or concept/prototype models — is being led by Asia and Europe. Recent composites development announcements in China include:

- CSP VICTALL (Tanshan, China) has announced that Jiangling Motors Corp. (JMC) will use advanced composites for the pickup boxes of its new Yuhu 3 and Yuhu 5 pickup trucks, the first such use of composites in the Chinese automotive industry.

- Kingfa (Guangzhou, China), working with systems supplier Brose Fahrzeugteile (Coburg, Germany), has developed a door module, which uses three types of KingPly organosheets and KingStrong unidirectional tapes, augmented with pultruded PP-LGF injection molding material for ribs and complex surfaces, to cut weight 35% (1 kilogram) for the Ford Focus vs. a PP-LGF 30 door module carrier.

- Magna Exteriors formed a joint venture with GAC Component Co. Ltd.(GACC, Guangzhou, China) to begin production of thermoplastic composite (TPC) liftgates for a global automaker’s crossover vehicle starting in late 2018.

- Kangde Group (Hong Kong) entered an agreement with BAIC Motor to build an Industry 4.0 smart factory in Changzhou to produce CFRP car body and other components beginning in 2019 and scaling to 6 million parts/yr — its 66,000 MT/yr carbon fiber facility in Rongcheng will begin production in 2023;

- HRC (Shanghai, China) commissioned the first Rapid Multi-injection Compression Process (RMCP) automated composites production line from Carbures (El Puerto de Santa María, Spain); and

- Volvo’s new, separately branded electric high-performance car company Polestar started production of its first model, Polestar 1, in 2019 in the new Polestar Production Centre in Chengdu.

- The industry’s first carbon fiber composite pickup box was unveiled in 2018 by General Motors (GM, Detoit, Mich., U.S.). The first-ever composite bed for a full-size truck was actually built by GM in 2001, but the take-up rate on the Silverado and Sierra Pro-Tec box option was only 10% of what GM expected. Thus, it waited more than 15 years to try again. The CarbonPro pickup box, again an option, but for the 2019 GMC Sierra, was developed with Teijin Automotive(Tokyo, Japan), which acquired Continental Structural Plastics (CSP, Auburn Hills, Mich., U.S.) in 2017. CSP has years of experience manufacturing composite boxes for the Honda Ridgeline and Toyota Tacoma trucks, both made from chopped glass fiber sheet molding compound (SMC). The first-generation Honda bed was 30% lighter than steel when it debuted in 2005, but its 2017 update switched away from SMC in two of the components, opting for a direct long-fiber thermoplastic (D-LFT) for the sidewalls and headboard and for a short-fiber compound for the spare tire tray, both injection molded using glass fiber and polypropylene (PP). The 2019 GMC CarbonPro box also uses Teijin’s Sereebo thermoplastic composites manufacturing process, which combines a mat of 20-millimeter-long carbon fibers with nylon 6 that is compression molded for part cycle times of 60–80 seconds.

- This growing trend toward use of thermoplastics in automotive composites is aided by processes such as overmolding, where blanks made of woven or unidirectional fibers in a thermoplastic matrix — known as organosheet — are compression molded into a 3D shape while reinforced plastic is injection molded on top and around to form complex-geometry ribs, bosses, inserts and attachment points. Parts in development or production include seat backs, seat rests, airbag housings, A and B pillars, door cross beams, bumper beams and large floor components. Although overmolding is typically all-thermoplastic, the Opto-Light project, managed by Aachen Center for Integrative Light Construction (AZL) at RWTH Aachen University (Aachen, Germany), demonstrated thermoplastic overmolding onto a thermoset carbon fiber/epoxy shell to produce a 3D structural portion of the BMW i3 floor panel in a fully automated cell with a 2-minute cycle time. The project also showed the ability to use cure-state monitoring via Netzsch Gerätebau (Selb, Germany) in-mold sensors to achieve thermoplastic-to-thermoset joining without laser ablation as an intermediate step. This second advance stops compression molding of the high-performance, low-creep thermoset shell at the optimized time to leave sufficient reactivity in the epoxy resin to achieve covalent bonding, hydrogen bonds and/or semi-interpenetrating networks with the overmolded PA 6 thermoplastic.

- Notably, the Opto-Light demonstration part started with unidirectional (UD) tape. This trend to use UD tapes to reduce waste compared to woven or noncrimp fabric (NCF) reinforcements continues to grow. Because the tapes can be cut and placed precisely, very little scrap is produced and fibers can be aligned more precisely to match loads. One notable example is the CFRP rear wall for the Audi A8 luxury sedan made in a fully automated, Industry 4.0 production line by Voith Composites (Garching, Germany). It provides 50% weight reduction compared to three to five welded aluminum parts, and 33% of the drive cell’s torsional stiffness. The rear wall begins with Zoltek (St, Louis, Mo., U.S.) 35K carbon fiber which is spread into bindered, 50-millimeter-wide, UD tape, which is cut and laid at specified angles to form a tailored blank in a single machine — the Voith Roving Applicator. This blank is shaped into a 3D preform in a heated press supplied by FILL (Gurten, Austria) which adapts the pressure applied as it stamp-forms separate regions of the preform clamped in the forming tool made by ALPEX Technologies (Mils bei Hall, Austria). The completed preform is then injected with resin and press-molded using the Audi-developed Ultra-RTM process, which uses less than 15 bar of pressure compared to 140 bar common for high-pressure RTM (HP-RTM). Thus, only 350 kilonewtons of press force is needed compared to 2,500 for HP-RTM. Although the VORAFORCE 5300 epoxy resin cures in 90–120 seconds at 120°C, the total part cycle time is 5 minutes.

- Another alternative to HP-RTM is wet compression molding (a.k.a., liquid compression molding), which does use snap-cure resins and NCF, but also lower pressure. Instead of injecting resin into the preform, automated equipment spreads resin over the fabric and then transfers this into a thermoforming press. Eliminating the preforming step and offering cycle times less than 90 seconds and less-expensive equipment, BMW has predicted a significant increase in wet-pressed parts. Huntsman Advanced Materials (Basel, Switzerland) has developed a next-generation process called dynamic fluid compression molding (DFCM) that claims fiber volumes up to 65% and the ability to mold more complex geometries.

- For exteriors, ultra-lightweight SMC continues its push below 1.0 g/cc and carbon fiber is also gaining ground, with Polynt Composites (Scanzorosciate, Italy), Aliancys (Schaffhausen, Switzerland) and CSP all adding new SMC production lines over the past few years, all of which have the ability to make carbon fiber SMC. Polynt has also introduced Polynt-RECarbon recycled fiber SMC to its product offerings, as well as UDCarbon and TXTCarbon compounds featuring unidirectional and fabric reinforcements, respectively. The potential for these products can be seen in the front subframe development project completed by Magna International (Aurora, Ontario, Canada) and Ford Motor Co. (Dearborn, Mich., U.S.), which uses locally reinforced and co-molded chopped carbon fiber SMC with patches of SMC made with carbon fiber 0-degree/90-degree NCF. This SMC structural subframe must handle significant loads, supporting the engine and chassis components, including the steering gear and the lower control arms that hold the wheels. Though only a development part, it achieved an 82% parts reduction, replacing 54 stamped steel parts with two compression molded composite components and six overmolded stainless steel inserts, while cutting weight by 34%.

- Hybridizing SMC with prepreg is an approach used by Ford’s global Research and Advanced Engineering group teamed with its Chassis Engineering group in the U.K. to redesign a production steel suspension knuckle for a C-class vehicle. By co-molding layers of woven carbon fabric prepreg with chopped carbon fiber SMC, a complex-shaped, high-performance suspension knuckle was produced with a cycle time of less than five minutes and a 50% weight reduction. Other developments include Saint Jean Industries (Saint Jean D’Ardières, France) and Hexcel (Stamford, Conn., U.S.) developing a hybrid carbon fiber/aluminum version of a performance car suspension knuckle, which increased stiffness by 26% compared to an all-aluminum knuckle. Meanwhile, Williams Advanced Engineering (Grove, Oxfordshire, U.K.) has developed a CFRP wishbone that uses unidirectional carbon fiber and recycled carbon fiber nonwoven mat — up to 80% of the composite part, by weight — to cut weight 40% compared to conventional aluminum versions, yet its cost is comparable to aluminum forgings. The part molded is in 90 seconds using an HP-RTM process called RACETRAK for a 5-minute total cycle time, including layup.

- Pultrusion is another growing trend. In 2018, L&L Products launched its Continuous Composite Systems (CCS) pultrusions using polyurethane resin and glass, carbon or hybrid fiber reinforcement for automotive applications such as side sills and crash structures. Designed to replace traditional metal structures that require bulkheads for necessary stiffness, CCS pultrusions offer light weight — 75% less mass than steel and 30% less than aluminum — at an economic price. In 2019, the automotive industry’s first curved, multi-hollow pultruded carbon fiber bumper beam was unveiled in the 2020 Chevrolet Corvette Stingray. In development since 2016, the part is produced by Shape Corp. (Grand Haven, Mich., U.S.) using Scott Bader (Northamptonshire, U.K.) Crestapol urethane acrylate resin and Thomas Technik & Innovation’s (TTI, Bremervoerde, Germany) Radius-Pultrusion system. Pultrusion is again front and center in the MAI Skelett project, which thermoformed and overmolded UD carbon fiber thermoplastic pultrusions in a two-step, 75-second process to produce a demonstrator BMW i3 structural roof member. The part exceeds all previous version requirements, integrates clips for attachments and changes crash behavior from brittle to ductile failure mode for increased body-in-white (BIW) residual strength.

- One final trend is the move toward hybrid metal-composite structures. The System integrated Multi-Material Lightweight Design for E-mobility (SMiLE) consortium combined composites and non-ferrous metals to reduce mass and costs for the entire BIW structure of a battery-electric vehicle. The rear load floor module uses eight layers of 60-wt% UD glass fiber-reinforced PA6 Ultratape and 40-wt% glass fiber/PA6 Ultramid direct-long-fiber thermoplastic (D-LFT), both from BASF SE (Ludwigshafen, Germany). SMiLE developed a new process, taking a preconsolidated tape laminate and selectively reinforcing that with D-LFT where ribs and complex geometries are needed. This is then placed, along with two aluminum profiles and several metallic inserts, into a compression molding press and quickly cycled to form a 1.3-by-1.3-meter part. This rear module is adhesively and mechanically joined to a second, hybrid/thermoset composite forward load floor, made using RTM and carbon fiber-reinforced epoxy with integrated metallic inserts and local sandwich structures containing polyurethane-foam cores.

- In the FlexHyJoin project, managed by the Institut für Verbundwerkstoffe (IVW, Kaiserslautern, Germany), an automated process enabling a thermoplastic composite roof structure to be assembled into a metal BIW was achieved by laser pretreating metal brackets and attaching these to the composite roof bow via induction and laser joining. This was achieved in a single, automated production cell with integrated process control and inline nondestructive testing (NDT) with a cycle time of 140 seconds.

Boatbuilding and marine

- Boatbuilding and marine: Hinckley Yachts’ Dasher features carbon fiber/epoxy construction and electric propulsion. Source | Hinckley Yachts

The National Marine Manufacturers Assn. (NMMA, Chicago, Ill., U.S.) reported in 2019 that unit sales of new powerboats increased 4% in 2018, reaching 280,000, the highest total since 2007 for the U.S. recreational boating industry. NMMA predicts 3–4% growth for 2019 and noted that boat manufacturers have concentrated on new products, especially in fishing, watersports and pontoon boats. NMMA’s top trends for 2018 included:

- Wakesport boats represented the recreational boating industry’s highest growth in 2018 (9–11%), totaling 10,000 units.

- Pontoon boats increased 4–6%, to 58,000 units, valued for their versatility in use for fishing to cruising to watersports.

- Personal watercraft continued to stay strong, with an entry-level price, growing by 6–8% to 68,000 units.

The trends for larger production boats powered by outboard engines (compared to inboard diesel engines), as well as increasing use of carbon fiber (CF), epoxy resin and 3D printing continue. In the Jan. 2019 forecast by Boating Industry, Ryan Kloppe, director of sales at Statistical Surveys Inc., said his company was expanding its 16- to 40-foot reporting category to 45 feet. “People are building bigger boats,” he said, noting continued growth in larger boats powered by outboards for fishing and cruising.

- Examples of outboard-powered boats — more than 40 feet long, each with at least three or four engines clamped to the transom — include Scout Boats’ (Summerville, S.C., U.S.) 530 LXF (53 feet), HCB Yachts’ (Vonore, Tenn., U.S.) 53-foot Sueños and 65-foot Estrella center consoles, and Midnight Express’ (Miami, Fla., U.S.) 60-foot Pied-A-Mer. Outboards are chosen for their light weight and reduced requirement for systems and space inside the hull. As with cars, space in boats is at a premium.

- The increasing size and number of outboards per boat is driving the need for reduced weight in composite hulls and decks, but without sacrificing performance. The latter means not only long-term durability in the water but higher speeds and resistance to wave-slamming loads, as well as heat resistance beneath dark paint colors, which continue to be popular. Carbon fiber and epoxy provide a particularly effective combination, and, in fact, are used on Scout’s 530 LXF and 420 LXF models, manufactured via resin infusion. Carbon fiber is also used in HCB’s Estrella. Hinckley Yachts (Southwest Harbor, Maine, U.S.), renowned luxury production builder and longtime veteran of resin infusion, has begun switching all of its sailing and power models to epoxy, while its 40-foot Sport Boat models and Dasher fully electric motor yacht feature CF/epoxy construction. Note, however, that these brands represent the high end of the market. Boats priced in the middle of the market typically use glass fiber and vinyl ester resin, though resin infusion has become much more common. Polyester resin is still used for the lowest-priced boats. Carbon fiber is creeping into medium-priced boats, used to cap hull stringers and in accessories like hard tops where owners are willing to pay for higher-priced options.

- Price, however, is an issue, as explained by an Ohio respondent to Boating Industry’s survey: “The industry has priced product out of reach for the middle-class boater. The guy who bought the ‘starter’ boat and allowed boat builders and motor companies to grow has been removed from the market. We need to target a younger crowd with [affordable] price point boating products.”

- One boat trend that might appeal to a younger market is electrification. “As hybrid gas/electric cars such as Tesla and Prius have grown in popularity and become more practical options for mainstream consumers, boat manufacturers have begun to follow suit,” explains a 2019 guide for buyers on Boattrader.com. Though electric-drive boats have been heralded as “the future” for some time, and were actually the norm for powerboats before the 1930s, their advance into today’s market has been slow. However, with battery and hybrid power technologies dropping in cost thanks to the auto industry’s continued development, sailboats and small cruising power boats are being introduced that eliminate the tanks, fumes and environmental impact of fossil fuels. Examples include Hinckley’s Dasher, the 12-meter long, 16-passenger Soel Cat 12 by Soel Yachts (Delft, Netherlands), the 7.47-meter 740 Mirage Air center console by Frauscher (Gmunden, Austria), Q Yachts’ (Finland) Q30 tender and the Secret 33 water taxi, ElectraCraft’s (Westlake Village, Calif., U.S.) electric pontoon boats and Greenline Yachts’ (Begunje, Slovenia) line-up of electric and hybrid models 10 to 21 meters long. This trend is expected to gain more momentum as reliable cruising range and speed are established (note the new electric boat speed record of 88.6 mph set in July 2019). Most docks already have electrical power for recharging.

- A project reiterating this point is the all-composite hydrofoiling watercraft developed by SeaBubbles (Paris, France) with support from composites fabricator Décision SA (Ecublens, Switzerland) and Sicomin Epoxy Systems (Chateauneuf les Martigues, France). This eco-conscious taxi transport solution for the world’s urban waterways is based on a hydrofoil design that allows the watercraft to glide silently above the water when it exceeds 12 kilometers per hour, which reduces drag 30–40%. A clean-charging electric drive system converts solar, wind and water power so the vessel does not generate any CO2emissions. SeaBubbles began testing the craft on the River Seine in Paris in September 2019; if all goes well, commercial service could begin in Paris in 2020. The technology’s makers hope to spread SeaBubbles to more than 50 waterway-rich cities worldwide.

- Another trend is the growing use of 3D printing in marine. Already, high-end yachts are using 3D-printed parts. For example, Hinckley’s Dasher electric features a stylish console supported by six parts that nest and interlock, 3D printed in partnership with the University of Maine’s Advanced Structures & Composites Center (UMaine, Orono, Maine, U.S.). According to Hinckley’s director of engineering Scott Bryant, the tight-tolerance pieces would have been difficult to produce with traditional molded fiberglass reinforced plastic (FRP) due to resin shrinkage. Now, the UMaine Composites Center boasts the world’s largest prototype polymer 3D printer, largest solid 3D-printed object and largest 3D-printed boat. The 3D printer, called MasterPrint and produced by Ingersoll Machine Tools (Rockford, Ill., U.S.) in partnership with Oak Ridge National Laboratory (Oak Ridge, Tenn., U.S.), can print objects as long as 100 feet by 22 feet wide by 10 feet high, depositing 500 pounds of material per hour. UMaine’s claim on the largest 3D-printed boat is its 25-foot, 5,000-pound 3Dirigo, being tested in the Alfond W2 Ocean Engineering Laboratory, an offshore model testing facility with wave basin.

- The world’s first 3D-printed boat was a 6.5-meter-long and 3-meter-wide Mini 650 sailing yacht, designed by Livrea Yachts (Palermo, Italy) and built by sister company Ocore in partnership with Autodesk (San Rafael, CA, US), Lehvoss Group (Hamburg, Germany) and Kuka Robotics (Augsburg, Germany). Ocore is using fused deposition modeling (FDM) via a mounted extrusion head on a 2.5-meter-tall Kuka robot. The head melts compounded 25% chopped carbon fiber-reinforced polyamide (PA, or nylon) pellets and deposits 0.6-millimeter-thick layers to form the hull, rudders and other components. The hull is printed in sections called isogrids, which resemble an aerospace skin-stringer design, with a CFRP corrugation between two CFRP skins. The isogrids are joined with structural adhesive and sheathed with skins of carbon fabric. Advantages claimed include a hull built in just days, enabling the team to print different hulls, analyze the speed forecast and identify the optimal shape.

- While printing boat structures is just at its beginning, the move toward 3D-printed molds is continuing to gain momentum. Projects completed include a boat hull pattern by Marine Concepts (Cape Coral, Fla., U.S.) and a 10.4-meter-long hull construction mold by Xplora Yachts (Kirkland, Wash., U.S.). The Marine Concepts pattern was a collaborative proof-of-concept project with Thermwood Corp. (Dale, Ind., U.S.) and custom compounder Techmer PM (Clinton, Tenn., U.S.). The pattern was 3D-printed slightly oversized, over roughly 30 hours, and subsequently trimmed to final size and shape, using Thermwood’s trademarked Large-Scale Additive Manufacturing (LSAM) system. The printed material was Techmer’s trademarked Electra l ABS LT1 3DP. The final tool was printed in six sections, four major center sections with walls approximately 38 millimeters thick and a solid printed transom and bow. Sections were pinned and bonded together using a Lord Corp. (Cary, N.C., U.S.) multicomponent urethane adhesive. The assembled pattern was then machined as a single piece on the same Thermwood system in about 50 hours. The entire print, assembly and trim process reportedly required fewer than 10 working days. The pattern was subsequently used to pull a fully functional production hull mold made with conventional fiberglass reinforced plastic (FRP) molding methods.

- The Xplora Yachts hull construction mold was 3D-printed start to finish, in partnership with Oak Ridge National Laboratory (ORNL, Oak Ridge, Tenn., U.S.) using its Big Area Additive Manufacturing (BAAM) machine, manufactured by Cincinnati Inc. (Harrison, Ohio, U.s.). Although three mold sections could be printed simultaneously in 12 hours, all 12 sections of the mold were printed over a five-day period, using 2,495 kilograms of 20% chopped carbon fiber/ABS Electrafil J-1200 from Techmer PM at $11/kilogram for a total material cost of $27,500. The sections were printed with an extra 3.8 millimeters of material which was later machined to a smooth surface. Rods were assembled cross- and length-wise to build the sections with Ashland’s (Dublin, Ohio, U.S.) Pliogrip Plastic Repair 10 epoxy applied to the seams. Designed for ABS, the epoxy adhesive’s 60-minute cure time allowed alignment adjustments during assembly. Assembly was completed in three hours and the adhesive cured within 24 hours. A Faro (Lake Mary, Fla., U.S.) laser-tracking system was used to compare the mold surface to original CAD data and showed an average deviation of less than 1.27 millimeters. After being sanded and coated with tooling gelcoat and mold release, the mold was used to resin infuse a prototype E-glass and Kevlar foam-cored hull.

- Future molds may be printed in thermoset composites, however, using the new Reactive Additive Manufacturing (RAM) machine, developed by Magnum Venus Products (MVP, Knoxville, Tenn., U.S.) in collaboration with Polynt Composites (Carpentersville, Ill., U.S.) and ORNL. Unveiled in Sept. 2019 as the world’s first large-scale thermoset composite additive manufacturing system, the RAM prints in a build envelope of 8 feet by 16 feet by 3.5 feet using Polynt Reactive Deposition PRD-1520 print media that cures at ambient temperature without UV activation. This technology is aimed at low-cost fixtures, thermoforming tools and autoclave molds, as well as a wider range of applications that require higher thermal properties afforded by thermoset polymers.

- The RAM system includes the large print platform and a floor-mounted MVP pumping system, with only the printhead mounted onto the computer-controlled gantry. The pumping system accurately measures and meters the short glass fiber-reinforced vinyl ester resin and peroxide initiator into a static mixer in the printhead. The mixed resin is then extruded through a nozzle, similar to most fused deposition modeling (FDM) systems. Print speed is roughly 1.2 m/s using a 1.2-millimeter diameter nozzle. RAM reportedly can achieve FDM-scale features while still delivering a high output of almost 7 kg/hr (15 lb/hr).

Civil infrastructure

- Civil infrastructure: Composite Advantage’s (Dayton, Ohio, U.S.) fiber-reinforced polymer (FRP) FiberSPAN system was recently used by the Nevada Department of Transportation (NDOT) to build a shared-use path along Nevada’s State Route 88. Source | Composite Advantage

- Composites offer light weight, corrosion resistance, high strength and long lifespan — qualities that make them a natural fit for infrastructure projects. And while composites are already being used to rehabilitate roads, bridges, water/drainage systems and seawalls, and to build resilient structures, widespread adoption has yet to occur.

- However, the role of composites in infrastructure is at an interesting point. In August 2018, bipartisan legislation was introduced in the U.S. aimed at encouraging research and use of innovative materials for infrastructure projects. Known as the Innovative Materials for America’s Growth and Infrastructure Newly Expanded (IMAGINE) Act, the bill seeks to lead decision-makers involved in construction and infrastructure projects to consider innovative materials as an option. The idea behind the legislation is that education about the benefits and properties composites will help designers and engineers rethink infrastructure projects.

- Aging infrastructure continues to offer a potentially huge market for composite materials. According to a 2019 report from the American Road and Transportation Builders Association, more than 47,000 bridges of the more than 600,000 bridges in the U.S. are in poor condition and in need of urgent repairs.

- Decaying bridges are just one of the infrastructure concerns that have encouraged the development of a number of composites-enabled technologies. The early deterioration of concrete due to the corrosion and failure of steel rebar has been well documented. Conventional repairs could cost billions. In many locales, the useful life of corrosion-prone steel-rebar-reinforced concrete is limited to 25 years, rather than the 75–100 years once promised by its advocates. Therefore, the lifecycle cost advantages, not to mention the safety benefits, of using composite rebar continue to overcome resistance among change-averse municipalities.

- Progress is being made. The critical need for bridge designs that can resist corrosion and extend useful life are a big part of growing awareness of the role composites — particularly fiber-reinforced polymer (FRP) — can play in rehabilitating crumbling infrastructure. Projects such as pedestrian bridges are slowly helping to build the case.

- For example, Composite Advantage’s (Dayton, Ohio, U.S.) FRP FiberSPAN system was used by the Nevada Department of Transportation (NDOT) to build a shared-use path along Nevada’s State Route 28. The NDOT and the Tahoe Transportation District opened the new Tahoe East Shore Trail in June 2019. Traveled by more than 1 million visitors every year, State Route 28 is a two-lane, mountainside road bordering 11 miles of Lake Tahoe’s undeveloped shoreline. NDOT initiated a shared-use path project to support expectations of doubled traffic over the next 20 years, while protecting the area’s ecosystem and dealing with problems of limited parking at the site and lack of safe access points. Composite Advantage’s FiberSPAN was chosen to meet the demands of constructing a shared-use path on the region’s uneven slopes. Thirty-two 40-foot bridge span sections were installed on an 11-mile section of the path. The spans were grouped to create five distinct bridges, used in areas where the slope was too steep to provide flat walking surfaces. The FRP decks are 134 inches wide and have a 5-inch structural thickness at the thinnest section, with a 1% cross slope. The panels were coated with a 1/8-inch non-slip polymer aggregate surface, and weigh 8.8 psf. The deck weight, including wear surface, curbs and railing, is 12 psf. Specification requirements called for a uniform live load of 90 psf pedestrian loading. Mid-span deflection of the deck is limited to L/500 and the mid-span deflection of the superstructure is limited to L/360. Vehicle maximum loading is rated at H-5 for a rear axle load of 8,000 pounds. Mid-span FRP deflection is limited to L/300, and uplift load is rated at 30 psf.

- In addition to the bridge decks, Composite Advantage’s offerings include composite pilings and fender systems, which have been used to rehabilitate aging waterfront infrastructure including bridges at a seaside resort at the southern tip of New Jersey’s Cape May Peninsula and the Jamestown-Scotland Ferry Terminal in Virginia.

- In other parts of the world, composites use in replacing civil infrastructure continues to advance. In 2019, FiberCore Europe partnered with Sustainable Infrastructure Systems to produce composite bridges in Australia. FiberCore Europe’s InfraCore Inside technology enables composite structures that meet all standards and government requirements while providing a practically maintenance-free service life of 100 years. More than 900 bridges and lock gates — from bicycle and pedestrian bridges to the world’s longest bridge span in composites — have been installed in the Netherlands, Belgium, England, France, Italy, Sweden, Norway, China, the U.S. and now in Australia.

- Technologies such as additive manufacturing are beginning to play a larger role in infrastructure projects as well. For example, Royal HaskoningDHV (Amersfoort, Netherlands), CEAD (Delft, Netherlands) and DSM (Amsterdam, Netherlands) have designed a lightweight, 3D-printed, fiber-reinforced polymer (FRP) pedestrian bridge prototype. The bridge consists of a glass fiber-filled thermoplastic PET (DSM’s Arnite) reinforced with continuous glass fibers during the 3D printing process. This combination is said to offer high strength, versatility and sustainability.

Construction

- Construction: Core Composites has developed its all-composite, fast-build Joint Warfighter Shelter of the Future. Source | Core Composites

- In the 21st century, one of the more compelling human stories is the growing need for resources to house Earth’s expanding population, and the growing awareness that those resources are finite and, in many cases, increasingly scarce. One case in which that contrast is acute is residential housing. The United Nations foresees a deepening global housing crisis — more than 440 million urban households will be in need of affordable accommodation by 2025. But conservationists warn that the sustainability of Earth’s forests, the source of the lumber to build those accommodations, is at serious risk. This conflict has done much to pique interest in fast-build construction technologies based on fiber-reinforced composites. As the new century’s third decade begins, composite manufacturers’ efforts in the housing arena are picking up speed.

- An example of composites use in a fast-build application is an all-composite military shelter developed by Core Composites (Bristol, R.I., U.S.). The Joint Warfighter Shelter of the Future (JWSOF) is funded by the U.S. Army Medical Command (San Antonio, Texas, U.S.) and is a next-generation surgical, rigid wall shelter with an exterior of a 20-foot ISO shipping container that expands via a series of lightweight composite expanding walls, roofs and floors. Core says the shelter is stiffer, stronger, 41% larger and 25% lighter compared to legacy aluminum shelters. The composite system comprises carbon fiber fabric, fire retardant resin, PET foam core and a multi-side infusion manufacturing process. Core Composites used A&P Technology’s (Cincinnati, Ohio, U.S.) QISO carbon fabric for the project.

- Use of composites in marine pier structures is also growing. An example of this is the Manahawkin Bay Bridge that links mainland New Jersey (U.S.) to Long Beach Island. New Jersey Department of Transportation (NJDOT) authorities wanted to surround the bridge’s deepest structural piers with energy-absorbing structures that would prevent damage to them from a large, out-of-control vessel. In this case, NJDOT specified an impact load or force of 40.76 kip-ft, which it calculated would be produced by a 200-ton hopper barge, the largest vessel that NJDOT knew would ply the waters beneath the bridge, says House. The Manahawkin piles would be fendering piles, which would need to resist lateral loads. The hollow tubes would be driven down into the sea bed far enough so that the soil friction provides fixity, to hold them in place. These tubes would then be filled with concrete.

- To make the piles, heavy quadraxial fabrics supplied by Vectorply Corp. (Phenix City, Ala., U.S.) are combined with polyester or vinyl ester resin, supplied by Polynt Composites (Carpentersville, Ill., U.S.) or other suppliers, in a proprietary manufacturing process that combines vacuum infusion with centrifugal casting. The closed mold is spun to help compact the fibers during the infusion process. The quadraxial fabrics ensure that at least 50% of the fibers run axially along the pile length, and about 25% of the fibers end up as hoop direction reinforcement. The remainder are oriented at 45 degrees. All piles are gel coated, with product supplied by Polynt Composites or INEOS Composites (Columbus, Ohio, U.S.) for added durability and appearance.

- On the horizon, keep an eye out for the Lucas Museum of Narrative Art, currently under construction in Los Angeles’ Exposition Park near the Unviversity of Southern California. The museum, founded by filmaker George Lucas and his wife, Mellody Hobson, Co-CEO and President of Ariel Investments, was designed by architect Ma Yansong and features a highly organic and unusually shaped design that will feature new public green space, state-of-the-art cinematic theaters, a research library, numerous spaces for onsite education, restaurants, retail and event spaces. It will also feature significant use of composite materials.

Industrial applications

- Industrial applications: Hudson Product’s Wickert press, used to mold the Tuf-Lite IV fan blade.

- Although the use of composites in high-performance end markets like aerospace and automotive often receive most of the industry’s attention, the fact is that most of the composite materials consumed are applied to non-high-performance parts. The industrial end market falls into that category, and here material performance often emphasizes corrosion resistance and durability, particularly in applications involving the storage of chemicals and gases.

- Indeed, composite storage tanks are proving increasingly valuable in several geographic regions. In South America, Tecniplas (Sao Paulo, Brazil) has developed a strong reputation for the fabrication of large composite storage tanks that contain everything from water to fertilizers to industrial solvents. In the U.S., Ershigs (Bellingham, Wash., U.S.) has established its own niche as a supplier of composite tanks, piping, ducts and scrubbers.

- Emblematic of the type of work being done in industrial composites is Hudson Products (Hudson, Beasley, Texas, U.S.), a manufacturer of air-cooled heat exchangers and axial flow fans. The company’s fiberglass Tuf-Lite axial flow fans have been in production for more than 60 years, with more than 250,000 in use globally. The Tuf-Lite fan series got its start in 1955 with the Tuf-Lite I, featuring a glass fiber-reinforced composite blade. Since its creation, the fan has gone through a few iterations. Tuf-Lite II was introduced in 1984 to increase the manufacturability of the fan’s parts, followed in 2004 by Tuf-Lite III. Tuf-Lite II and Tuf-Lite III fan designs use a proprietary vinyl ester resin in a resin transfer molding (RTM) manufacturing process. For the newest version, the Tuf-Lite IV, the company employed computational fluid dynamics (CFD) technology for a design that focused on noise reduction and efficient airflow. Tuf-Lite IV is also 20% larger. Hudson turned to Wickert Hydraulic Presses (Hebron, Ky., U.S.; Landau, Germany) for a new custom press, which enables changes to the layup sequence, type of fiberglass, material configuration, number of layers, resin injection points and positioning of vent lines. The result is a more efficient, more effective fan blade.

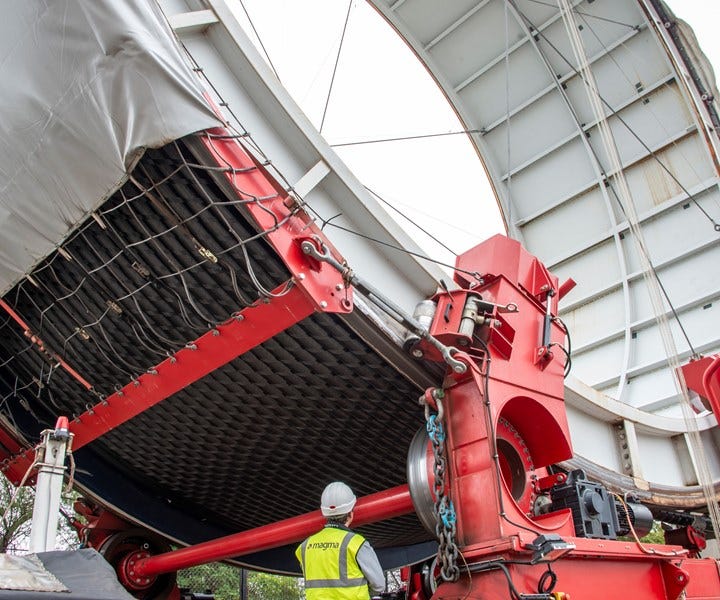

- One of the more unusual recent industrial applications of composites was a rail bogie, the four- or six-wheel trucks that support rail vehicles and provide traction and braking. The prototype bogie, developed in the U.K., is made primarily with recycled carbon fiber composites but is supplemented with virgin carbon fiber composites in places that require additional strength or stiffness. The bogie was developed by ELG Carbon Fibre Ltd. (Coseley, Dudley, U.K.), which supplies the recycled carbon fiber and performed much of the materials testing; Magma Structures (Portsmouth, U.K.), designer and fabricator of the rail bogie; the University of Birmingham (Birmingham, U.K.) Sensors and Composites Group, which worked with Magma to develop an embedded health monitoring system for the bogie; and the University of Huddersfield (Huddersfield, U.K.), on whose dynamic test rig the prototype is to undergo initial full-scale testing. Alstom U.K. (London) helped to assemble the consortium and has provided additional support through consulting and existing bogie design information. The consortium selected ELG’s Carbiso M, a nonwoven mat made with standard modulus fiber (strength of 4 to 5 GPa) in an epoxy matrix. They demonstrated that the fatigue performance of the recycled carbon fiber/epoxy is similar to that of conventional woven carbon fiber laminates — and better than that of structural steel. Finite element analysis (FEA) performed by Applied FEA Ltd. (Southampton, U.K.) verified fatigue service loads as well as exceptional static loads. The prototype is 36% lighter than the steel alternative; the composite frame itself yields a 64% weight savings, but the prototype suffers a weight penalty from paint and the tapping plates needed to attach the steel fittings. Considering the frame alone, the 590 kilograms of weight saved is estimated to produce an annual savings in operating costs of between £8,000 and £62,000, depending on the train’s service type and mileage. Additionally, each bogie frame could reduce CO2 emissions through its lifetime by as much as 68 metric tonnes.

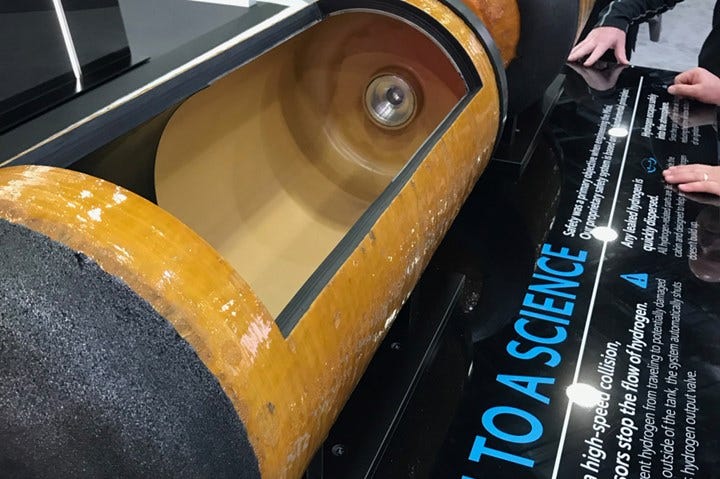

- Also emerging is the increased use of composites in tanks used to store cryogenic liquids. Along these lines, Cimarron Composites (Huntsville, AL, US) announced in 2018 that it had made a leap forward in all-composite cryogenic tank development, achieving 15,000 micro-strain performance with a carbon fiber-reinforced composite tank in a pressurized liquid nitrogen environment. Successful operation at such a high strain level allows the liner-less composite tank structure, made with a mixture of textiles and continuous wound fibers, to be much thinner than what was previously needed in these types of tanks, without the cost and mass of the liner. According to Cimarron, earlier composite tank programs were limited to 3,000 micro-strain due to materials and processing limitations, and this resulted in extra mass. Cimarron’s new tank technology uses a material system that performs well at extremely low temperatures without developing the microcracks that create leak paths for fluids like liquid oxygen, liquid hydrogen or liquid methane.

Electronics

- Electronics: SABIC demonstrated in a recent study that a 1-millimeter-thick cover could meet all relevant industry performance specifications for very thin notebook computers or tablets.

- The consumer electronics market is one of constant change. Products such as smartphones, smartwatches, tablets and laptops evolve quickly. OEMs scramble to keep up with consumer demands: faster operating speeds, more features, longer-lasting batteries.

- When it comes to covers, cases and frames for such products, OEMs are seeking materials with strong aesthetics and design freedom, good impact resistance and high stiffness at low weight with thin wall sections. There is also a need for cost-effective, high-volume processing methods that can meet global production demand in the tens of millions of units annually.

- A feasibility study conducted by SABIC (Bergen op Zoom, Netherlands) involved use of two types of thermoplastic composites to produce a 1-millimeter-thick notebook-computer/tablet cover. The study showed the hybrid thermoplastic composite design could be a viable solution for the challenging consumer electronics market.

- Covestro’s (Leverkusen, Germany; Shanghai, China) Maezio brand of continuous fiber-reinforced thermoplastic (CFRTP) composites, which launched in October 2018, is also attracting interest in the electronics industry. The product line includes unidirectional (UD) reinforced tapes and sheets made from carbon fibers impregnated within a polycarbonate (PC) matrix. According to Covestro, the CFRTP can be tuned for performance, aesthetics and economies of scale, and can be used in products in a range of industries. Maezio can be thermoformed at high yield rates and shorter cycle times, and is said to reduce costs for millions of parts per year. Other production technologies such as overmolding, automated tape laying (ATL) and automated fiber placement (AFP) can also be integrated. The main advantage of Maezio is its tuneability. The UD tapes, which are just 120 microns thick, can be laminated at different angles to form sheets tuned to meet a variety of performance and mechanical criteria. Resulting sheets are strong, stiff, lightweight and have a natural, unidirectional surface finish. In addition, CFRTP composites are recyclable.

- While covers and cases get a lot of attention, composites also play a substantial role in interior electronics components. For example, Samsung’s (Seoul, South Korea) Galaxy Note9, which launched in 2018, employs a Water Carbon Cooling system that is said to allow the phone to run more smoothly during heavy use. According to Samsung, the cooling system consists of a heat pipe, or “thermal spreader,” that water phase changes to efficiently dissipate heat. First, a porous structure filled with water absorbs the heat, then the water is turned into steam and moved through pipes. As the steam begins to cool and turns back into water, the process begins again. The Galaxy Note9 has a larger heat pipe than its prede cessor and also benefits from an enhanced carbon fiber TIM (thermal interface material) that is said to transfer heat from the processor to the thermal spreader with 3.5 times greater efficiency, boosting thermal conductivity and helping to prevent overheating.

- In addition, glass fiber/epoxy laminates have been the foundational structural substrate in printed circuit boards (PCBs) for decades. These iconic thin, green “cards” support the transistors, resistors and integrated circuits at the heart of almost all digital technologies, and connect them electrically via conductive pathways etched or printed on their surfaces. Multilayer PCBs are made by interleaving copper clad (and etched) laminates with high resin content (HRC) prepreg layers and then compressing into an integrated structure. Holes are then drilled and plated with copper to create vias connecting the etched circuits within. The cores serve as the structural units while the HRC prepreg provides dielectric insulation between adjacent layers of copper circuits.

- According to industry sources, the global PCB market is expected to reach an estimated $80.1 billion by 2023, with a CAGR of 3.3% from 2018 to 2023. Market growth factors for the PCB market include increased adoption of automation in various end-user industries, increased demand for wireless devices, increasing miniaturization of devices, the need for increased efficiency of interconnected solutions and increased demand for flexible circuits.

- Glass fiber/epoxy’s dominance in the electronics market has been under challenge as many of these trends — notably, miniaturization, better thermal management, increased speed and performance, and 3D printing — force PCB manufacturers to re-examine their material options.

Fuel cells and batteries

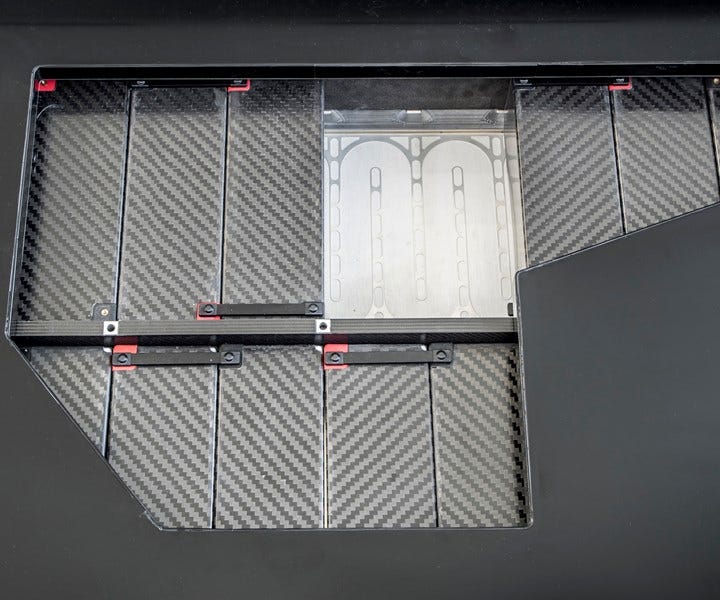

- Fuel cells and batteries: Williams FW-EVX features CFRP battery module boxes made with the 223 fold-to-form process.

- More than 80 concept, demonstrator and/or test-fleet fuel-cell-powered electric vehicles have been fielded by 25 automakers worldwide since General Motors (Detroit, Mich., U.S.) unveiled the first, its GM Electrovan, in 1966. The most recent to the market is the Toyota Mirai. There have also been a host of fuel-cell-powered trucks, buses, racing vehicles, a motorcycle, four rail locomotives and some ocean vessels, including submarines. Fuel cells also power an increasing number of stationary systems that provide heat and light to other structures. According to global analyst IHS Markit (London, U.K.), use of battery-electric vehicles (BEVs) is expected to expand to as many as 90% of all vehicles in western countries by 2025, but hydrogen fuel cell vehicles (HFCVs) may quickly become a more aggressive competitor as new technologies develop. Eleven large corporations have formed the Japan H2 Mobility cooperative and the German counterpart H2 Mobility Germany, and both have targets to increase H2 fueling stations, up from 100 and 69 currently. Though California lags in stations (36), it boasts the most HCVs on the road at 4,410. Multi-client studies by IHS Markit forecast a significant share of hydrogen in the mobility sector by 2050, led by global truck and car manufacturers like Toyota, Nikola Motors, Hyundai and Bosch. IHS Markit suggests that in order for this growth to take place, hydrogen prices will first need to come down from current levels.

- There are also opportunities in non-transportation sectors including decarbonizing energy use for industry and local electrical power. The U.K. is exploring the possibility of converting its natural gas grid to H2 with its ongoing North of England H21 project, due to begin in 2028. Residential and commercial heating and cooling accounts for about 40% of final energy demand in Europe.

- Composites can make up the bipolar plates, end plates, fuel tanks and other system components of proton exchange membrane fuel-cell (PEMFC) systems, still the leading type. In the past, thermoset materials were thought to be limited to lower volume and stationary applications, due to their longer mold cycle times, higher scrap rates and an inability to produce molded composite plates as thin as stamped metal plates. More recently, however, these issues have been overcome, providing a clear advantage for composites over metals in high-temperature and low-temperature PEMFCs where power density is a secondary requirement. Chopped carbon fiber and graphite-filled/vinyl ester bulk molding compounds (BMCs) are finding wide use in bipolar plates for low-temperature PEMFCs. BMC cost has declined significantly as volumes have increased. Similarly, molding cycles once measured in minutes are now routinely completed in seconds, due to formulation improvements and the ability to make thinner plate cross sections.

- Chopped carbon fiber is also finding use as a porous paper backing material for gas diffusion layers in PEMFCs. Prepared by wet laying chopped PAN-based fibers, these can be manufactured in high volumes and low thickness. SGL’s (Wiesbaden, Germany) SIGRACET gas diffusion layers are being used by Hyundai Motor Group’s (Seoul, South Korea) new NEXO fuel-cell vehicle. Accordingly, SGL has increased SIGRACET production at its Meitingen facility.

- Toyota Motor Corp. (Tokyo, Japan) began selling its Sora fuel cell bus in March 2018, and it was the first such vehicle to receive type certification in Japan. The company plans to introduce more than 100 Sora fuel cell buses in Tokyo, ahead of the Olympic and Paralympic Games in 2020, and launched an updated version of the bus in August 2019. Teijin Carbon (Tokyo, Japan) announced it has developed a multi-material roof cover for the Sora comprising carbon fiber composites, aluminum and engineered plastics. The part is manufactured in one piece with complex shapes and is suitable for mass production.

- Hydrogen-powered fuel cells are also being developed for aircraft, with prototypes launched in 2019 by Alaka’i Technologies (Hopkinton, Mass., U.S.) and ZeroAvia (Hollister, Calif., U.S.). The Skai, developed by Alaka’i, features a carbon fiber composite airframe and landing skids, and is said to be the first eVTOL powered entirely by hydrogen fuel cells. ZeroAvia is flying a Piper Malibu refit with carbon fiber composite hydrogen tanks.