From Euro 2020 to the Summer Olympics, the summer sporting calendar is awash with exciting events, and regular betters are clamouring to place their wagers on their top picks in a bid to walk away with a fortune. Worth upwards of £15 billion annually in the UK alone, the sports betting market is a lucrative one – but a growing number of savvy investors are finding a new way to turn it to their financial advantage.

While having a flutter at the races or on the latest football match is undeniably fun, the chances of a big win tend to be relatively small – but those in the know have found that the true gains come from investing in the sports betting market itself. Getting your hands on the right stocks and shares could stand you in good stead to gain a lucrative slice of the pie, making you some substantially greater – and often, more reliable gains – so it’s little wonder that some of the most clued up investors on the block are a step ahead of the masses.

If you’d rather bet on the stock market than your favourite sports team, then you’re in increasingly good company. Here, we take a look at some of the best investments to keep your eye on this year.

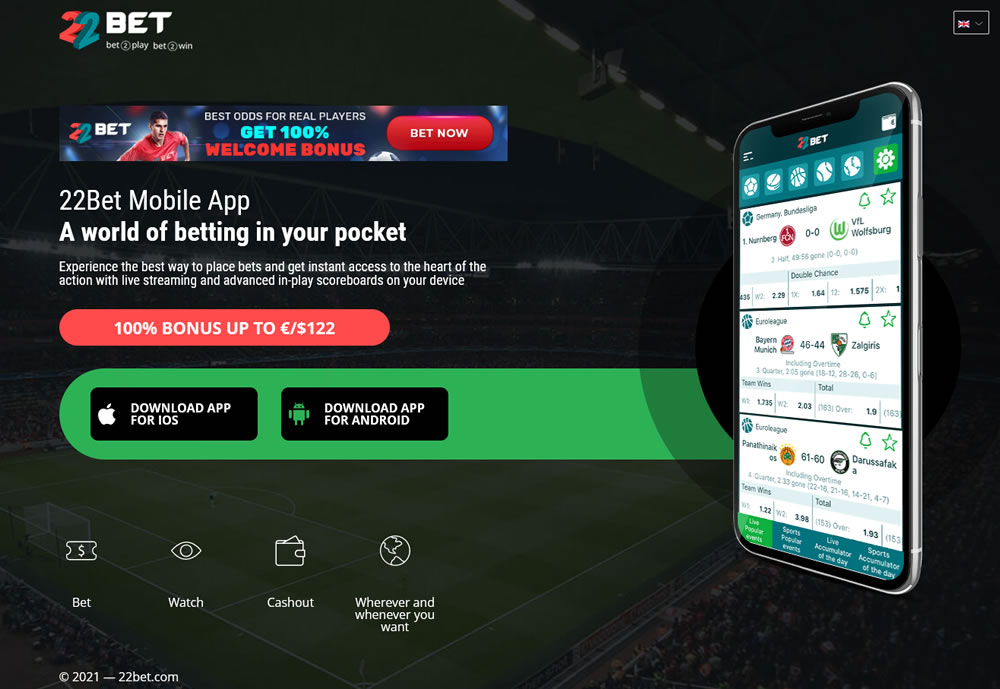

22Bet

When it comes to sports betting, today’s users look for two things above all else – convenience and accessibility. A growing number of companies are clamouring to take advantage of the latest technological innovations in a bid to win over the lion’s share of the online betting customer base, and one that is disrupting the industry at present is 22Bet.

With a thoroughly modern betting app that is attracting thousands of new users every day, the 22Bet platform allows gamblers to place bets and get instant access to all of the action, with live streaming and advanced in-play scoreboards making for an exciting and immersive experience.

Available on both IOS and Android, it has been gaining increasing attention since its launch, and is a prime example of where investors could be looking to purchase some shares. Innovative brands that can give gamblers what they want, when they want it and allow them real time access are certain to flourish, and this is where we’d be placing our bets on some financial gains.

DraftKings

If you’re eager to dabble in a spot of investing across the pond, then DraftKings could be a profitable place to start. Having formally entered public markets in a $3.3 billion deal shortly after the pandemic swept the world and disrupted the global economy, the stock has since seen a sharp spike in value, now standing at an enormous 450 percent higher in value than it did at the same point last year.

So, what exactly is it? Think a more laid-back alternative to fantasy football, which continues to grow into new and interesting sports such as UFC.

William Hill

The UK sports betting market is primed to profit from the surging US sports betting interest after it was widely legalised across multiple states. According to casino executives from MGM and Hard Rock, the industry could soon be worth billions of dollars a year – and 85-year-old bookmaker William Hill is at the front of the queue.

William Hill’s investors have suffered somewhat in recent years, with its prices sinking to a five-year low back in 2018 when UK laws on profitable fixed-odds terminals were tightened. But the brand is already fairly well established in the US’ market in Las Vegas, and it was announced earlier this year that it would be the exclusive sportsbook provider to CBS Sport Digital. Providing William Hill with privileged access to its 80 million monthly users, suffice it to say that things are looking pretty good – and with planned expansion into at least six US states, this is one stock that appears to be on the rise.

Caesar’s

Another option for across-the-pond investors is the behemoth sportsbook and entertainment company, Caesar’s, which although perhaps better known for its casino operations – both online and off – has already begun dipping its toe into the world of sports betting to take full advantage of the recent change in US law.

With land-based casinos and racetracks already spanning 54 properties across 16 states, there is little denying that Caesar’s has both clout and reach, so much so that it is seen as a natural beneficiary of the growing US interest in sports betting. Its sportsbook is now operational in 15 states, and aims to expand to a further five by the end of this year alone.

Disclaimer: Investing money carries risk, do so at your own risk and we advise people to never invest more money than they can afford to lose and to seek professional advice before doing so.

The post How to invest in sports betting in 2021 first appeared on Luxury Lifestyle Magazine.