A. Two ways to do it .

- MOU with EESL / NTPC

- The Power Ministry through EESL ( Energy Efficiency Services Limited) is procuring charging stations upto 120 Kw for 2W/3W/4W(cars + light vehicles).

- While the ministry of heavy industries through navratna companies like NTPC are procuring charging stations in the range of 300 kw for Trucks / Buses.

- Both are working with the urban local bodies ULB’s to study the traffic densities within city limits and outside to decide the mesh of charging stations.

- They have finalized guidelines which have the thumb rule of 1 charging station per 3 km radius within city limits while on the highways they shall be spaced at a distance of 25 kms on both sides of the road.

- EESL / NTPC have a business model to centrally procure charging stations and install on highways/ nodal points like the premises of retail chains ( fuel retailers, hotels, retail chains, hospitals, logistics hubs, warehouses etc) and maintain the charging stations with a profit sharing mechanism wherever they are located on retailers premises.

- The interface with the utility companies shall be handled by EESL/NTPC for distribution transformers etc.

2. Procure / Install / Maintain our own charging stations

- Here there is choice of installation of charging stations on fuel retails outlets and also extend it to the retail chain.

- The interface with the utility companies shall be handled in-house.

- We have been doing due diligence on the various companies available for procurement of the best range of charging stations.

- A converged model of charging staions and smart metering solution (Electricity, Gas, Water, Heat) is being pursued.

- GPRS ( 2G/3G/4G) communication for smart meter products to communicate with the utility systems ( AMI / DCU / HES / MDMS etc in case of electric utilities as part of the SMART GRID standards). This is necessary as the latest tender from the ministry has ruled out the RF based static meters. Legend : AMI — Advanced Metering Infrastructure, DCU — Data Concentrator Unit, HES — Head End System, MDMS — Meter Data management System.

B. RIL-BP to install EV Charging Stations Networks For EV

- Recently, Reliance Industries Ltd (RIL) and BP plc made an announcement to offer the electric vehicle (EV) charging stations at their energy stations across India.

- This comes in the backdrop of RIL and BP JV having announced on 6 August their fuel retailing partnership for India.

- The joint venture, which is owned 51% by RIL and 49% by BP, plans to set up 5,500 fuel retail outlets across India.

- RIL, said the second official, is expected to tap the expertise of BP for its EV charging and battery swapping initiatives

- BP had in 2018 June acquired Chargemaster, the UK’s largest EV charging company, and renamed it BP Chargemaster.

- The company operates Polar, the largest EV charging network in the UK, with more than 7,000 public charging points, providing a comprehensive public charging solution

- Energy stations will have EV charging facilities as well as petrol, diesel, CNG, and LNG facilities.

- The establishment of EV charging points by RIL is because to help the government plans for electric vehicles adoption, sales and to cut down the crude oil imports.

- RIL holds a license to set up 5,000 fuel retail outlets and BP has 3,500 outlets. RIL had spent Rs 5000 crore to set up 1,470 outlets between 2004 and 2006 out of the 1,378 are operated by it and 516 outlets and remaining are dealer-owned.

- As JIO-BP plans to go forward is providing electric charging at the retail sites and networks.

- EverSource Capital, the joint venture between private equity firm Everstone Capital and global solar project developer Lightsource BP, is also looking to invest over $1 billion in renewable energy investments through its Green Growth Equity Fund. The National Investments and Infrastructure Fund (NIIF) of India and the UK government are anchor investors in Green Growth Equity Fund.

- The $1 billion Green Growth Equity Fund we manage with partners in India will support the Indian government’s plan’s to increase renewable capacity to 450 GW over the next few years.

- JIO BP has no plans in entering the electricity distribution business.

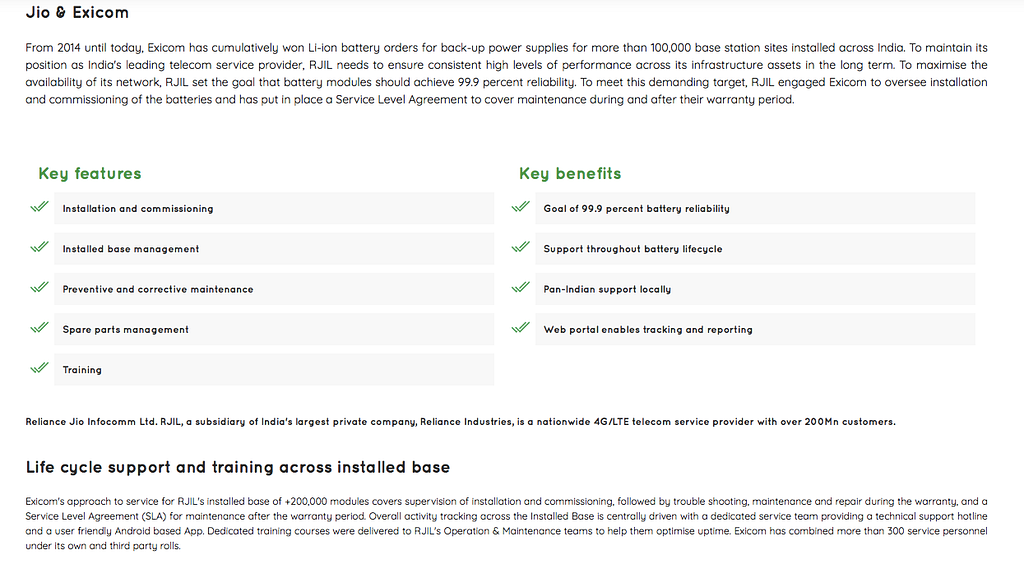

C. JIO Exicom Partnership

- In addition to conventional fuel options, RIL plans to provide a gamut of alternative energy options to its customers.

- This includes electric vehicles (EV) charging points, battery swapping stations, freight aggregation, telecom towers power.

- Jio | Jio with Exicom | Case Study | Power Systems | Li-ion Batteries

- Li-ion Battery | EV Battery | Electric Vehicle Battery | EV Battery Solutions | Two-Wheeler Battery | Three-Wheeler Battery

- EV Charging Solutions| Electric Vehicle Charging Solutions

- Battery Management System | Battery Optmization | Electric Vehicle Battery | Li-ion Battery | Battery Telematics | Cell Supervision Module

D. Reliance Jio starts trials for running EVs delivery fleet

- Reliance Jio is running trials of electric vehicle delivery. The company with collaboration with some of the startups and well settled major players.

- The pilot launch of its new commerce venture started in July 2019 with the announcement about the expansion of its commerce venture to use electric vehicles in the delivery fleet for sustainable delivery options.

- Reliance Jio will have lakhs of delivery vehicles in its new commerce venture.

- India’s eCommerce idea is a huge success mostly during the festive seasons.

- The company wants to reach to the masses not being just an eCommerce player.

- The Reliance business model will provide a technology platform for millions of small merchants all over India and strengthens the business.

E. RIL JIO Gigafactory

- Reliance is mulling Lithium-ion Battery manufacturing in India.

- In what will be the biggest private investment in a new industry in recent years, India’s leading business groups are readying plans to enter battery manufacturing and battery pack assembly with investments running into several billion dollars over the next decade or so.

- Read about the Giga Factory Design on this link.

BackGround

- This comes at a time when a lack of charging infrastructure is one of the main reasons behind poor adoption of electric mobility in India.

- The National Democratic Alliance (NDA) government on its part plans to install one electric vehicle charging station after every four kilometers in cities and twenty five kilometers on both ways of highways connecting to these cities.

- In Union Budget 2019, acknowledging the need for a reliable EV infrastructure in India, finance minister Nirmala Sitharaman invited global companies to set up mega manufacturing plants in sunrise and advanced technology areas including lithium storage batteries and charging infrastructure.

- The plan to increase charging infrastructure will go through different phases wherein the mega cities with a population of over 4 million and highways connected to these cities will be considered in the first one- to three-year period. Subsequently, in the second phase within three to five years period, big cities like state capitals, union territory headquarters may be covered for distributed and demonstrative effect. The government will also install separate charging stations for heavy electric vehicles like buses or trucks after every 100 kilometres on both sides of highways.

- This comes at a time of a crisis in Indian electricity distribution companies (discoms) because of their poor financial health, which has resulted in delayed payment to generation utilities. The discoms owe ₹76,336 crore for the power bought from the generation companies (gencos) at the end of July, according to information available on the union power ministry’s PRAAPTI portal. This comprised ₹56,710 crore as the overdue amount.

- Chargemaster is the operator of the UK’s largest EV charging network and the leading supplier of EV charging infrastructure.

- Acquisition is an important step in scaling up and deploying a fast and ultra-fast charging network on BP’s UK forecourts.

- Chargemaster to be rebranded BP Chargemaster.

Global Scenario — Electricity As The New Oil — The 5.8+ Trillion USD Opportunity That We Are Missing — Challenges we face to stay saddled as “The Energy Company of Tomorrow”

- The global oil and gas market including distribution is just 2.3 Tn while the emerging Electricity Driven Industry 4.0 Mobility Infrastructure of the future brings in a replacement value of 5.8 Tn and more as an opportunity.

- It’s wise for oil companies to diversify. But the most astute forms of diversification stay close to the original business even while shifting to “Oil to Chemicals” future business model.

- Hence when the cost and performance of emerging technologies like Windmills, Electric Cars, Solar Panels, Charging Stations, Battery Storages ( Lithium / Solid State ), Smart Grid etc improves, incumbents get nervous and should get nervous about being disrupted. Eventually the oil age will end, and it won’t be because we’ve run out of oil. But because something better / cheaper has come along.

- It’s inevitable, and the question is how oil and gas business stays ahead in help existing energy cmpanies to remain saddled as “The Energy Company of Tomorrow”.

- Most energy companies have always been an energy company as per the main objects in their MoA / AoA. And being an energy company, of course, should lead them into electricity, which is the fastest-growing segment of energy consumption.

What has changed — — “Big Oil’s Big Power Dreams” :

- Oil companies want to become power utilities to meet rising demand from electricity in transport and from growing populations. They see their future in providing energy services, from smart meters to batteries to charging stations to energy efficiency applications to distributed internet of power/batteries/charging stations and many more adjacent markets ( listed below ), that can ultimately generate higher returns.

- Technological progress and the threat of climate change are forcing both oil companies and utilities to rethink their strategies, and are pushing them into each other’s territory. Big Oil turning into Big Power and replacing the traditional utilities from the top spots is a very realistic prospect. Big Oil has not just the ambitions but the means to achieve them: no renewable power company can compete with any of the supermajors on revenues or profits.

- There is also the question of shareholder value for oil industry leaders to consider. Can Big Oil afford to increase spending in their embryonic electricity businesses and still maintain adequate levels of expenditure on their conventional oil and gas divisions, which remain the main drivers of profits and investor returns is a big question being raised.

- The decline in capital expenditure in new oil production has been flagged as a major concern for policymakers seeking stable crude prices. The world could require at least another 30 million barrels per day of new crude capacity by 2040 to meet demand, replace ageing reservoirs and keep prices affordable. On the oil side of the energy industry, pressure from investors is forcing companies to look at ways to curb greenhouse gas emissions, while the rise of electric vehicles is threatening to put a brake on the growth in demand for crude.

- It is expected that electricity demand will grow from 28,000 terawatt-hour (TWh) in 2018 and double in 2060, or from 18% of final demand in 2018 to 29% in 2060. Advances in electric storage and renewable energy, both empowered by digital capabilities are key areas that dictate the pace and the scale of the energy transition. The dramatic increase of renewable energy capacity across the globe, notably for wind and solar PV, will continue and further advance the role of renewable energy in the global energy mix. It is expected that solar & wind power will rise from 4% in 2018 to between 21 and 42% in 2060.

- Natural gas is the only fossil fuel for which there is no demand peak in the next decades. However, there is a cloud of uncertainty hanging over the golden age of gas with great variance in plausible future demand dynamics according to the future scenarios. Gas provided for 22% of electricity supply in 2018. This moves to anything between 17 and 32% by 2060, which corresponds to an absolute increase of between 300 to 1500 billion cubic metres (bcm).

- Diverting capital into electricity markets could be a distraction but a major game changing opportunity if played well.

Sizing the Market Opportunity : The total replacement value of the following mobility infrastructure & adjacent markets is 5.8+ Tn USD :

Transportation : This shall be replaced by EV infra as most nations are adopting state funded measures to speeden up this transition. S&P Global Platts Analytics forecasts that plug-in EVs — including rechargeable hybrids — will account for nearly half of global auto sales by 2040, displacing some oil demand as a transport fuel and expanding the role of the electricity sector.

- Global bus market is projected to cross $ 52 billion by the end of 2022.

- Global truck market was valued at $ 218 billion in 2018, and is projected to grow at a CAGR of over 8% to reach $ 352 billion by 2022.

- Global Car & Automobile Manufacturing industry has grown by 4.5% to reach revenue of $3tr in 2019.

- The global bicycle market size is expected to reach USD 75.47 billion by 2025.

- The global Vehicle to Everything ( V2X ) market is expected to grow at a CAGR of over 25.4% from 2018 to 2024 reaching 26.72 Bn by 2025.

- The global oil and gas market including distribution is 2.3 Tn.

- Recent budget announcements have been very promising. Under NEMMP, FAME 2 has attractive subsidy elements and DHI along with Niti Aayog have drafted a phased wise manufacturing plan ( PMP ) for indigenization of EV vehicles ( buses, trucks, cars, bikes, three wheeler, LCVs. To come in future are electric flying cars/bikes, electric submarines/cruises etc ). If India does not transition to EV, the oil import bill shall rise to 350 Bn USD by 2026 from the current 135 Bn USD which is why the Govt is keen to subsidize this transition.

- EESL and NTPC NVVN are aggregating the EV / Charging Infra from all the STUs for procurement tendering.

- ARAI and other bodies have been entrusted with the testing and homologation certifications. We have ARAI standards with us related to all the four areas of certification namely AIS-038- functional safety, AIS-039-energy consumption, AIS-040-electrical range, AIS-041-measurement of net power , AIS — 048 Battery Safety, AIS-049-Type of approval. Details enclosed.

- We have done full research and have a list of target companies in the entire EV spectrum for acquisition.

- We also have completed a full study on setting up a manufacturing facility as per the BOM of these EV’s.

Adjacent Markets to Explore : On the utility side, meanwhile, electric cars offer an opportunity for expansion at a time when sluggish economies and rising efficiency have slowed demand growth to a crawl. Electric mobility is potentially an important opportunity and by 2040, 40 per cent of the vehicles [sold] worldwide will be electric, this opens up tons of business opportunities, not only in the consumption of electricity but also in the management of the charging stations, batteries and a whole lot of other adjacent markets listed below. The falling costs of renewables and batteries, and innovations in grid management, are breaking down the standard model of electricity supply. Households and businesses can have access to their own local resources, such as rooftop solar panels, battery storage and demand response technology, reducing electricity consumption when there is strain on the grid.

- Energy Management System ( EMS/SCADA), Distribution Automation System ( DMS ), Substation Automation System ( SAS ), Advanced Metering Infrastructure ( AMI ), New Energy Generation Automation System, Smart Gas System, Smart Water System, Smart Heat System, Multi Meter Integration, Internet Of Smart Energy ( IoE ), Electric Vehicle ( EV ) Charging, Energy Saving Solution, Water Conservancy Informationization Application Solution, Information Security Solution, Virtual Power Plant ( VPP ), Distributed energy Resources, Integrated Energy Portal ( IEP ), Digital identity for EV, Payment Solution, Blockchain based power trading, Smart Grid, Internet of Chargers, Internet Of Batteries, Aluminium Light Weight Cars, Solid State Battery, Infotainment, Driverless Vehicles, Mobile Office, Shareability, LED Light, Smart City Automation, Cybersecurity, Smart Cars, Smart bikes, Smart LCVs, Smart Three Wheelers , Charging stations, Lithium mines etc.

- Metered power is important for India as DISCOMs have accumulated losses of 3.8 Tn INR and debt of 4.3 Tn INR. India has 200 Mn legacy meters. There are plans to install 130 Mn smart meters by 2021. We have identified target companies with a full end to end metering solution which fits well into our smart home solution as well.

- Govt plans to invest 25 Bn USD in smart grid technologies by 2025. We have done full research and have a list of target companies in the entire Smart Grid / EVSE spectrum for acquisition. We have the complete standards for the smart grid http://www.nsgm.gov.in/en/nsgm as well as target companies to deliver an end to end solution.

- The economic opportunity from manufacturing battery storage in India is worth 13.7 Lakh crores. Details enclosed. We have the complete guidelines for the Lithium Ion batteries. For solid state batteries, we have developed a specification on the basis of Tesla owned solid state battery company.

- The economic opportunity from manufacturing charging stations in India is worth 2 Lakh crores. Guidelines are enclosed. While in Europe, North America and some other countries the Combined Charging System (CCS) has been defined as the fast charging standard, Japan has so far relied on CHAdeMO and China on its own GB/T standard. Tesla, on the other hand, has opted for its own variant. However, the Californians are installing an additional GB/T charging socket in the electric motors, especially for the Chinese market. In addition, Tesla recently announced that it would equip its Model 3 in Europe with a CCS charging connector. CHAdeMO and GB/T share more than 90 per cent of the global fast-charging market, but they see their current dominance being threatened in the long term, since CCS is supported by major players such as BMW, Ford, General Motors and VW. The development of a common new standard can, therefore, be seen as a frontal attack on the CCS warehouse, which is organized in the Charging Interface Initiative (CharIN). Both the CHAdeMO Association and the China Electricity Council emphasize the open approach of their project, which should explicitly leave room for proposals from other countries. However, a few things are also set: Both partners want to continue to rely on the Controller Area Network (or CAN bus), which is a standard for communication within and between vehicles and chargers and which CHAdeMO and GB/T already have in common. In addition, it is already clear that the new charging standard for ultra-fast charging should be downward compatible with the existing CHAdeMO and GB/T standards.

Impact of digitalization on the future of the energy system which argues that electricity is the new oil.

- The new energy world is one of more players, different rules and new markets. The way the energy sector has developed over the past 100 years is about to change significantly and we need to be ready with agile thinking, flexible investments and dynamic business models to respond to this grand transition. When it comes to the energy transition, electrification is on everyone’s lips. It is absolutely clear that electricity is the new oil. This energy source is going only one way, whereas others like coal or gas are peaking, declining or stagnating. Electrification is firing demand, which will double by 2060.

- The one thing above everything else that is keeping energy leaders awake at night is the impact of digitalization on the future of the energy system as the way we produce and use energy is changing in all parts of the world, driven by a combination of factors including the fast-paced development of new technologies, an unstoppable digital revolution, global environmental challenges, as well as changing growth and demographic patterns which will impact operating models and the economic foundation of both nation states and businesses, leading to a rebalancing across sectors and regions with knock-on effects on the wider global economy. The world shall see a deepening of the electrification of final demand, with electricity rapidly becoming the ‘new oil’. The combination of digitalization, decentralization and new technologies will drive new business models, change the way we think about supply-demand interaction and challenge our current thinking on issues such as national tax and regulatory sovereignty, privacy, price solidarity or cybersecurity. We will see a greater diversity in types of actors and business models, enhanced system response capability through digitalization and more decentralization and direct interactions between prosumers and devices enabled through technologies such as BlockChain.

- Decentralized energy systems may not always be the preferred option for governments and certainly not for traditional energy utilities initially; governments and energy monopolies may lose control and others gain from the decentralization of energy which will empower local communities, organizations and individual consumers, particularly when energy consumers also produce energy — for example, through the wind and solar installations that they own.

- Renewables have become the main action priority due to the increasing understanding of renewable energies and its potential to reduce the need for importing fossil fuels.

- Electric storage has decreased in uncertainty recently but its impact has increased due to its potential to improve renewable energies. It has also become important in electrifying transport and heating.

What Are Energy Companies Doing : Ten years ago, we knew where we stood with our energy suppliers. Oil companies sold road fuel, while utilities supplied electricity and gas. Today, those old lines of demarcation are blurring: utilities can fill up our car and oil companies want to keep our lights on. When Big Oil majors started buying EV charging networks and battery producers, they probably earned some praise for venturing into new business directions away from their increasingly unpopular core business. Now, they are taking this a step further: supermajors have super utility plans. It was only a matter of time, really. Integrated oil companies know the importance of covering the whole supply chain in an industry, so it only made sense to grow into power generation once you’ve established a presence in one of the biggest growth segments in power demand: electric vehicles.

- Vitol, the world’s largest independent energy trader intends to focus on cleaner fuels and power trading in the coming years.

- Total, the French oil and gas group, has a similar message as they have publically stated that they are an energy company and is being even more aggressive, posing a direct challenge to incumbent conventional utilities in their domestic markets. In France, Total recently acquired Direct Energie for more than 1.7 Bn USD. The deal pits it against the state-owned market giant EDF. By 2022, Total aims to be supplying electricity to 6 million customers in France and 1 million in Belgium. Total, sees EDF’s 80 per cent share of the French retail market as a tempting target. Electricity will be the energy of the 21st century and Total is using every opportunity to expand there by becoming a utility as well as an oil and gas company after a string of acquisitions across power generation (Eren), battery manufacturing (Saft), and power distribution (Direct Energie, Lampiris).

- Iberdrola of Spain, also among Europe’s largest utilities, has signed deals with car companies to work on electric vehicle systems. It has announced an agreement with Nissan to work together in Spain, Britain, the US and Brazil on ways to integrate electric cars into the grid. Other vehicle manufacturers it is approaching aggressively.

- Shell has been acquiring companies along the electricity supply chain, from renewable generation to battery storage to electric vehicle charging and domestic power. Shell suggests 30 per cent of its business could be in electricity by the mid-2030s making them the largest electricity power company in the world by that time. Bloomberg reported that the Anglo-Dutch supermajor was pouring US$2 billion annually into its new energies division that aimed to expand its presence in cleaner power generation. Like Total, Shell is growing through acquisitions in the power generation and distribution sector as well as in EV charging and batteries. This power plan fits in with the company’s strategy of reducing the portion of oil in its overall production to 25 percent from 50 percent and raising the portion of gas to 75 percent. What’s more, however, Shell specifically plans to materialize its power ambitions by betting on renewables rather than on conventional power generation and distribution. It has already announced its First Utility retail power business which is rebranded as Shell Energy, with 700,000 households switching to renewable power. Customers will be offered not only cleaner electricity but discounts on fast-charging for their electric vehicles as well as broadband and smart-home technologies.

- Meanwhile, Enel, the Italian electricity group that by some measures holds that title today, has led a rapid growth in its network of electric car-charging points. By the end of 2018 it had installed 49,000 worldwide — up 63 per cent during the year.

- To become the world’s biggest renewable generator, meanwhile, would require an annual expenditure in the region of $2 billion initially, according to a report by S&P Global Platts.

- By comparison, Spain’s Iberdrola — a European sector leader — ploughed over $5 billion into green power generation growth . Iberdrola has 29 GW of renewable electricity capacity installed worldwide.

- Shell has 1.6 GW of solar and will have 5 GW of wind on completion of committed investments. And Shell isn’t alone in wanting to forge into these new markets.

- BP claims it is now generating enough power from wind renewables to feed 400,000 homes.

- However, utilities can’t match the financial muscle of big oil. NextEra Energy, the world’s biggest renewable generator in the US, had a turnover of around $17 billion last year, which is less than Shell made in actual profits over the same period. Gobbling up rivals in the power sector is relatively cheap when armed with an oil company’s gigantic balance sheet.

- Globally, it’s not just international oil majors going electric. State-owned fossil fuel producers are increasingly looking at the sector for growth. Saudi policymakers have for the last decade harbored dreams of the kingdom being the biggest exporter of solar-generated electricity in addition to crude oil. Elsewhere in the oil-rich Gulf, petrodollar sheikhdoms are pumping billions into renewables.

- US oil companies are also coming under more pressure to diversify.

EV terminology :

- EV Driver (EVD) — Individual or entity with authority to determine PEV charging preferences and priorities to meet transportation needs.

- Power Flow Entity (PFE) — An offsite entity that is requesting or mandating VGI activities from other actors downstream.

- Utility Customer of Record (UCR) — Individual or entity identified as the meter customer account holder on the utility records with the authority to determine constraints on the utilization of energy at the meter account location.

- EV Battery System (EVBS) — The vehicle energy storage management and charge control system that will provide direct interface and communication to process and execute VGI functions.

- DC Power Converter System (DCPC) — The off-vehicle power converter that controls DC energy flow to or from the EV Battery System.

- EV Supply Equipment (EVSE) — The equipment that connects the AC electricity grid at a site to the EV.

- Energy Meter (EM) — Measures the PEV charge or discharge (or site) energy. Can exist as a whole-house or whole-facility meter, separate circuit-level submeters, embedded EVSE meters, on-board vehicle meters, and EVSE-embedded meters.

- Building Management System (BMS) — A collection of sensors and controls intended to automate management of energy flow and use at a site location or facility.

Of course, declines in consumption by motorists will be compensated by growth in petrochemicals and industrial transport like shipping.

In tilting from hydrocarbons to electrons, oil companies will have to find a balance between serving their fossil fuel past while investing in their electric future.