RIL Bets Big On 5-Year Bonds Before RBI Decision

- We at RIL run one of India’s biggest treasury operations.

- And we went on a shopping spree for local five-year bonds just weeks ahead of a crucial central bank policy meeting.

- We bought about $270 million worth of state bonds from a single state-run bank, with others adding that total purchases exceeding $1 billion in last few days on the central bank platform.

- Many years now our treasury has been more profitable than businesses. Our finance cost comes to 6.55 per cent of gross debt, while the return from cash investments comes to around 8 per cent.

- SFO plays a crucial role in setting up of such ultra modern treasury functions for many of our UHNWI clients and Corporate Conglomerates. Equipped with thousands or Bloomberg Terminals, Reuters terminals, Deal Logic Terminals and Scores of other Central Bank Trade Desks we call our self as a truly platform based treasury. It looks like a NASA Rocket Control Room.

- With such successful treasury operations with own trade desks we now monetize external instruments within Private Placement Programs as well to satiate our hunger of more aggressive treasury operations

Arms & the art of unearthing value within

- The purchases by blazed through trading rooms in Mumbai, helping the five-year sovereign bond outperform as banks and brokerages sought to fulfill the orders.

- While we attempted to find the safest part of the yield curve as expectations grow that the central bank will tighten monetary policy soon.

- We were buying a mix of sovereign and local government debt maturing in 2026, and we bought debt on the central bank’s dealing platform as well as through direct deals with holders.

- The yield on the 5.63% 2026 bond is down four basis points to 5.68% this week, outpacing the drop in the benchmark 10-year bond.

- We have cash and equivalent assets worth $35 billion. Last year, we took a similar bet in corporate bonds with the similar maturity.

- The purchases come ahead of central bank meeting on Dec. 8, which will be keenly watched by investors to see what steps the central bank takes to normalize pandemic-era policy settings after it suspended bond purchases last month. Market is “heavily overweight” on tenors of about five years on expectations that they will be less impacted by rate hikes.

- Central Bank Governor Shaktikanta Das has repeatedly assured markets that getting economic growth back on a firm footing was of paramount importance and he will ensure adequate liquidity. Still, rising inflation globally has seen swap markets start to price in rapid rate hikes.

Pumping Up Treasury ops with Jio Deal Proceeds

- Our finance cost comes to 6.55 per cent of gross debt, while the return from cash investments comes to around 8 per cent.

- As we concluded the JIO deals of private equity in 2020, our balance sheet saw a new sizable revenue stream. We earned Rs 13,956 crore as other income, which is primarily the interest income from our cash on books in FY20 vis-a-vis Rs 8,386 crore in FY19.

- We had cash and cash equivalent of Rs 1,75,259 crore at the end of March 2020. It stood at Rs 1,33,027 crore in March 2019. The reserves had been parked in banks, mutual funds, corporate deposits and government bonds and other marketable securities.

- The cash portion surged with the deal proceeds flowing in. Jio Platforms Ltd (JPL), subsidiary of RIL, has signed 12 deals -- with Facebook and the global private equity giants like Silver Lake, Vista, KKR, Mubadala, General Atlantic, PIF and ADIA -- for raising Rs 1,17,588 crore by selling 25.09 per cent stake.

- Besides, we also concluded the Rs 53,124-crore rights issue. Of this, we received 25 per cent of the amount during the time of subscription. The remaining amount came in 2021. We also sold to BP Plc 49 per cent stake in fuel retailing joint venture for Rs 7,000 crore. Another big deal in the making is with Saudi Aramco, which is to pick up 20 per cent stake in Reliance's petroleum and chemicals business for Rs 1.1 lakh crore.

- Major portion of the proceeds was used to reduce the gross debt of Rs 3,36,294 crore and we kept the rest as cash on books. It made the balance sheet net debt free (net debt is calculated by reducing the cash and cash equivalent from the gross debt).

- We spent Rs 22,027 crore as finance costs in 2019-20, as against Rs 16,495 crore in the previous year. The increase was primarily on account of higher loan balances, currency depreciation and lower interest capitalisation on account of commissioning of digital projects.

- The finance cost comes to 6.55 per cent of our gross debt, which is far lower than the prevailing interest rates in India. However, the return from our cash operations comes to around 8 per cent. It means we prefer to keep more cash on books rather than clearing off the debts.

- This shows a more aggressive approach to treasury operations, for better returns. Earlier, we followed a conservative approach, keeping more than half of our surplus in cash and bank balances, for less return but with an advantage in managing liquidity. Now, the current investment is more than four times its cash and bank balance.

- When economic conditions are bad and the realisation from core businesses are stressed, we try to maximise return on our capital through aggressive treasury operations.

- The growing importance of treasury operations for us is obvious, as its contribution to earnings is has been higher than core areas such as petrochemicals, oil and gas, and retail. The company earned Rs 8,335 crore from treasury operations in FY15, while Ebit (earnings before interest and tax) from refining, oil and gas, and retail, were less at Rs 8,291 crore, Rs 3,181 crore, and Rs 417 crore, respectively. We had the highest Ebit of Rs 13,392 crore from its refining business in the year.

- When we had not been able to create significant wealth for our shareholders, we try to maximise return from what is in our control.

- Which means the result from greater deployment of cash in current investments will reflect in the treasury yield.

- 27.55% of our record net in FY16 came from treasury income.

- In 2012-13, the contribution of treasury income stood at 37.14 per cent at Rs 7,800 crore. In 2013-14, this share was a whopping 40.53 per cent. For the financial year ended March 2015 the share of Reliance Industries Ltd's treasury profit stood at a high 36.04 per cent.

Home-grown treasury

- There are many benefits to the organic growth of our business, and one of them is that it has given us the space to grow our own treasury. Structurally, we have treasuries embedded within each of our business divisions; there is a treasury for the refining business, one for the petrochemical business, one for the consumer business and so on. The role of the central treasury, is to “lay down the broad boundaries, frameworks and priorities, and define how each individual treasury should interact with our banking partners”.

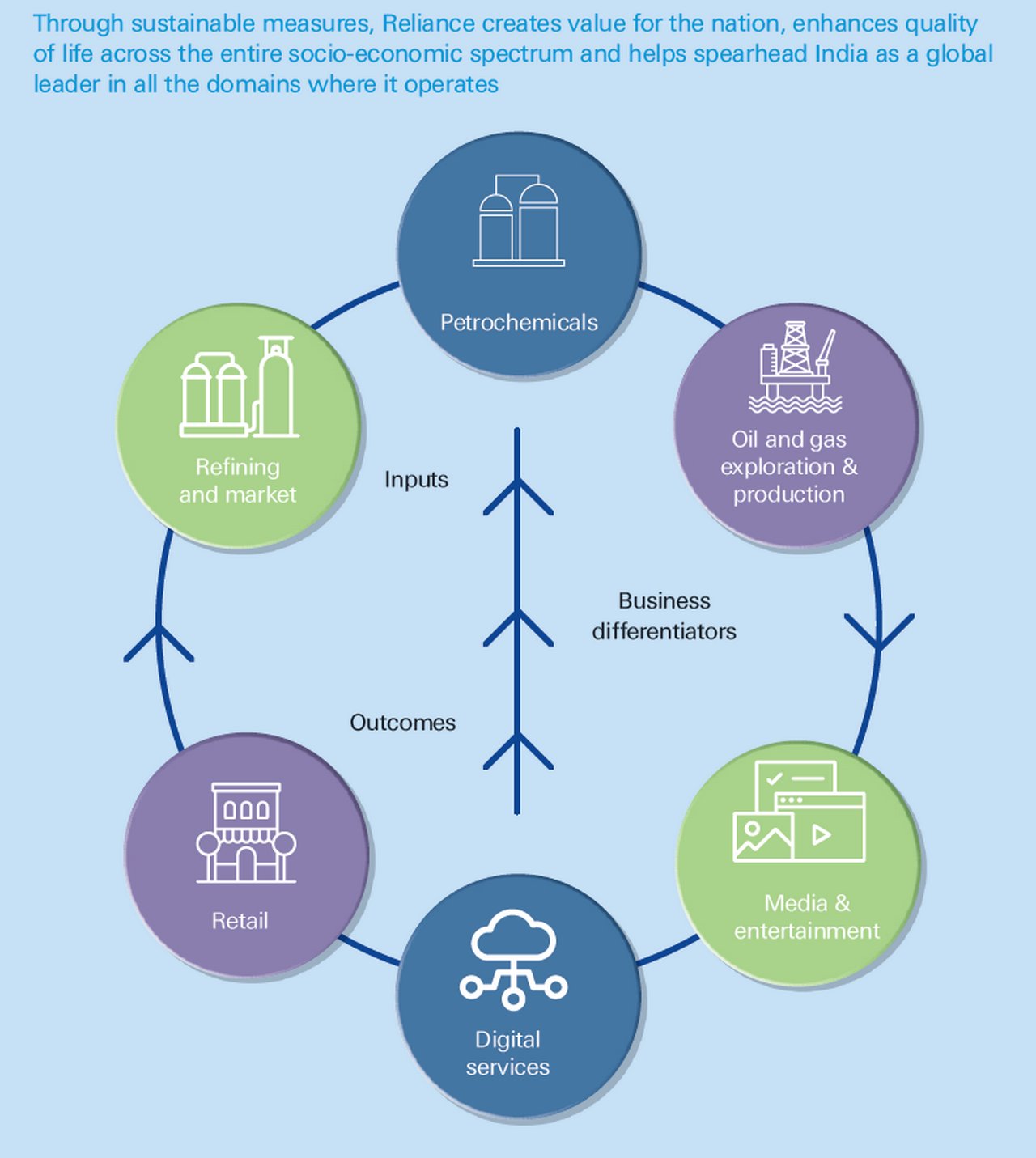

Figure 1: Reliance areas of operations and business model

- While each division will have its own needs from the company’s banking partners, it is the central treasury that agrees the prioritisation for the group.

- Given that we are an innovation-led company, it is no surprise that technology helps us to drive efficiencies within treasury.

- We use SAP as its enterprise resource planning system and Murex for treasury and financial markets, working with the providers to ensure there are linkages and interoperability between the two. We have also participated in several pilot projects with trade digitalisation specialist Bolero (on electronic bills of lading) and has joined numerous blockchain projects. Yet, given the company’s size, the scalability of any solution is the crucial determining factor.

Payments and the move to digital

- On the face of it, cash management across a diverse set of businesses would appear to be a challenge for us. Not only is the company a global operator, with all the challenges that brings, but it spans the full scale of payments, from high-value items in the hydrocarbons business to small, frequent payments in the consumer business.

- Yet that isn’t so, as we have different legal vehicles and work closely with banks that specialize in each domain, and hence are able to offer the right solutions for each of our businesses depending on our unique requirements. It has been a continuous learning process. Sometimes banks and service providers have offered us products and promises, only to realize that they had not anticipated the extent and pace of scaling up of transactions. Yet, for the most part, our banking service providers have understood our requirements and business aspirations and have been quick to make appropriate investments to provide us with the right tailored solutions.

- In the consumer space, digital payments constitute a significant theme for us. India’s payments system is among the most dynamic in the world, and in 2016 the government launched the Unified Payments Interface (UPI) initiative to turbo-charge the country’s digital trajectory. UPI allows account holders to instantly send and receive money using their smartphones with a single identifier – without entering any bank account information – at any time of day. The scheme has been heralded as a driving force behind the ubiquity of real-time payments in Asia.

- The entire ecosystem is changing, with the government pushing hard for digital payments. We still find a lot of store collections happening via cash and coins, which brings its own set of cash management challenges, but we are seeing this changing fast and digital payments are the new order of the day. Indeed, Reliance’s digital services business now receives most of its payments through digital apps or UPI. More than 10 million Jio recharges happen through UPI in a month.

Largest user of ECA financing

- On the energy side of the business, Reliance’s organic growth through investment in downstream capacity has provided us with an opportunity to explore a diverse range of trade finance instruments for both the capital and trade account. And our treasury team members have been very active users across the breadth of the company to meet our financing requirements, deploying a range of tools including buyer’s credit, seller’s credit, forfaiting and variants within supply chain finance. We have been able to use innovative instruments while raising resources, with different tenors, geographies covered and pools of investors.

- Yet, when it comes to long-term funding, export credit agency-backed (ECA) financing has been the go-to source. We are “the largest user of ECA financing in the globe”, using financing ECAs from Japan, South Korea, Italy, Germany, the UK, Canada and the US, to name but a few. We have been able to access very competitive rates that take care of our asset-liability mismatches.

- The long tenors offered by ECA financing are particularly helpful for larger projects with significant gestation periods. Telecommunications is a case in point. In September 2019, RIL, via Jio Platforms, signed a US$1bn 10-year loan, backed by the Korean trade insurer K-Sure, to finance the procurement of goods and services to expand India’s 4G wireless network. The standout deal was the largest-ever Indian loan covered by K-Sure, and its largest-ever telecom financing. It picked up GTR’s Deal of the Year and TXF’s Perfect 10 award in 2019 – not the first time Reliance has been celebrated for an ECA-backed deal by industry peers.

Managing market risk

- The diversity of our business certainly brings new and diverse challenges. When 95% of our earnings were derived from hydrocarbons, managing cash flow and FX risk were, to a certain extent, straightforward. We would import crude and sell to global markets – and, as a completely dollarised business, we could manage the FX risk. The growth in our consumer business has changed this dynamic. For the consumer businesses, we now import capital equipment from across the globe – dealing in many currencies – but the revenue for those businesses largely accrues from the local market, and that income is denominated in Indian rupees.

- This policy has required much more sophisticated hedging structures to help manage the risk. Of course, as Covid-19 has demonstrated, planning cannot account for every potential scenario. Look at the ‘taper tantrum’ of 2013, when US Federal Reserve Chairman Ben Bernanke dealt a major shock to investor expectations, announcing that the Fed would, at some future date, reduce the volume of its bond purchases, thus tapering its policy of quantitative easing. It was a key geopolitical shock that hit the company’s balance sheet in terms of interest rates and FX risk. Interest rates hit the roof and we saw a large outflow from global capital markets back to the US.

- It’s ironic that the pandemic now seems to have sent the Fed in the opposite direction. There is no such thing as a free market any more. All developed central banks have cut rates to zero and are buying trillions of assets. Inflation is very low.

Blue-sky treasury thinking

- We are always looking to new ideas and when it comes to our treasury set-up, the ‘blue-sky thinking’ centres on whether our treasury can be designed as a platform organisation.”

- Our Treasury aspires, to reorganise itself as a centralised, platform-based organisation through which various users spread across the business can quickly and efficiently request treasury services, whether it is working capital raises, long-term funding raises, or FX risk hedging.

- Existing IT systems, architecture and technology will need to be reconfigured and rewired while shifting to a platform strategy, which will probably not be without its challenges. We’re still a young organisation and we don’t have a lot of baggage to carry.

Treasury and The Complex Web Of Our Subsidiaries

- Although the subsidiaries hold potential to create earnings surprises, it is difficult to value them. Other than holdings of treasury stock, it is, however, difficult to value these other investments firstly due to their small earnings and secondly, due to lack of details on land and real estate investments.

- The market prices in treasury stock holdings, but other RIL investments in subsidiaries are normally ignored, both due to lack of detail and earnings. They are a fertile source of EPS surprises just waiting to happen. It’s a pity, though, that they don’t generate any regular income. If the money invested in RIL’s subsidiaries was instead invested in commercial paper, earning 5% post tax, EPS would be 11% higher.

- RIL’s 94 subsidiaries together make up for a sizeable balance sheet. Of the total balance sheet of the subsidiaries, 21% is invested in RIL treasury stock, 23% in gross block and 16% in land or real estate. In terms of the sources of funds, between 41% and 56% of the total funding came from RIL itself, close to one-quarter from retained earnings, while a mere 4% contributed by external borrowings.

- Apart from the extraordinary gains from the sale of the treasury stock, RIL’s subsidiaries generate a net loss. Continuing losses at overseas E&P projects & African retail operations surpassed the profits by Jamnagar SEZ.

- Extraordinary transactions have always been witnessed within the subsidiaries that hold treasury shares of RIL. While the number of shares has come down , their overall balance sheet value appears intact. Sale of shares at book value and a partial repurchase at a higher price seems to be the only possible explanation. This achieves an interesting result. The book value per share of the shares is lower. If these shares are now sold at current market price, no profit will be generated; so, no taxes will have to be paid on them.

- A company of RIL’s stature can surely make investments for strategic purposes that does not generate income in the short run. At the moment, lack of clarity prevents one from putting any value on these investments in the subsidiaries, when the company is valued as a whole. Investors mustn’t expect any short-term benefits flowing from these investments.

What is the function of corporate treasury?

- The treasury department has long guided the firm’s strategic agenda. If anything, the importance of the treasury function has grown more pronounced.

- The pillars upon which a firm’s financial health is held are these key functions — central to every investment, business decision, short and long term goals, and generally keeping the company within the parameters it seeks to determine itself. It provides the measure with which each department considers success, the future possibilities of the company as a whole, and directs the many cogs that make the firm work.

Cash Management

- The role of treasury to be able to manage cash — and other short-term assets to manage the firm’s liabilities — is not to be understated. The function may seem straightforward, but a great deal of resources and treasury intelligence is used in the cash management function of the world’s most successful firms and financial service providers.

- The ability to transfer longer term assets into short term, manageable and convertible assets such as cash is crucial to a company’s health. Transfer too much, and the company may lose out on profitable investments — from bonds or savings returns, or direct business investments. Conversely, if the company does not have enough cash at it’s disposal, it could face penalties in not being able to meet short-term liabilities.

- For multinational firms, the treasury function is responsible for moving cash through the system and across jurisdictions. This in itself requires a great deal of treasury intelligence, in being able to move the right sums around different units while factoring in the need to retain cash in a centralised system to factor for the unknown. With the cash management function, the corporate treasury will work closely with the finance and accounting departments, in a bid to make sure that the company is in good health and supporting its network.

Foreign exchange

- From the multinational firm’s perspective, the treasury management system’s role is perhaps obvious, but nonetheless pivotal to operations. Being able to manage the flow of funds across borders to different strands of the business while factoring in fluctuations in currencies — and monitoring for potential future changes in foreign exchange based on a variety of factors such as interest rates in different jurisdictions — has become more important in recent years as firms expand across global markets. Getting the foreign exchange function wrong can be costly, should the value of cash deteriorate as it crosses borders.

- For smaller firms, treasury’s capabilities to utilise proper foreign exchange functionality is no less important. Most firms in today’s global markets import and export goods and services, so naturally funds come in and go out in different currencies. Here, not only is it important for the treasury department to provide the requisite funds for transactions to be able to be carried out, but a modern treasury manager will recognise that arbitrage opportunities lie in the conversion of currencies at different rates at different times — and not necessarily in the company’s home currency.

Investments and funding

- One of the key metrics in an assessment of the performance of the corporate treasury department is its ability to successfully invest available funds while making sure short-term liabilities are accounted for.

- In assessing the likely returns of an investment, the treasury will work closely with the company’s finance department in order to consider both the investment proposition in itself, as well as the opportunity costs in providing funds for the undertaking. The treasury may analyze other possible opportunities, and decide that funds are better used elsewhere — or indeed required for the day-to-day running of current operations. In this instance, a corporate treasury will assess all known opportunities, weighing them up against one another in order to exploit the very best returns available. Sound treasury intelligence, and assessing the treasury risk of the propositions, will be critical in allowing the firm to grow and prosper.

- At any organization, a firm’s finance department and other corporate levels will embark on rounds of treasury consultations in order to assess the best values the firm can ascertain from different strategies. Here, the treasury department will use knowledge of different financial techniques and market intelligence to calculate and decide on the best course of action.

Financial supply chain

- The firm’s management of its funds across its supply chain will necessarily be decided upon by its corporate treasury, which it leans on for the smooth transition of those funds through its network.

- Much academic theory has been published on supply chain management, and that pertaining to the transfer of funds has become no less prominent. A treasury department’s ability to move funds fluidly, with ease, and at the discretion of the C suite as business models and economic environments change, is widely seen as the lifeblood of the firm. There are many software packages that can assist the treasury department to move funds around, but human interaction is still a large part of providing a subjective analysis of the firm’s short and long-term financial requirements.

Risk management

- Assessing a firm’s risk profile is a critical component in deciding which direction to drive the firm. When the C-suite has decided on the levels at which it would like the rest of the firm to set its exposures, the treasury is tasked with ensuring those risk levels are delivered.

- Further, the treasury will decide upon issues such as cash levels and exposures to different investment, based on those risk profiles. With that risk profile in mind, the firm’s treasurers will assess which exposures to press and which may need to be curtailed.

- There are various risk management techniques the corporate treasury will utilise. For instance, in order to mitigate financial risks, it may enter the futures markets, buying up derivative products in order to balance exposures and allow for greater investments in related areas. In extreme circumstances, the firm may analyze the company’s risk profile and decide to put more funds in longer term, safer investments such as government bonds, to reign in other risks currently being considered.

Regulation

- Ensuring that the company is in line with regulations is a key function for the corporate treasury, given how active it needs to be in various markets and its responsibilities for corporate finances.

- With the avalanche of regulations that have hit financial markets since the global recession and subsequent attempt by regulators to tighten those markets, the task of the treasurer to keep abreast of regulatory developments has become burdensome. Europe’s second Markets in Financial Instruments Directive (MiFID II) for instance, and more recently the General Data Protection Regulation (GDPR), both of which have ramifications for firms across the globe, treasurers have much to keep up with.

Financial technology

- The various software tools to have come on the market over the past few years promising to help company’s better use their financial supply chains and treasury systems have played a large part in supporting the treasury function. Many of these systems have added to the functionality of each firm’s treasury capabilities, but also created the need for the department to constantly assess the software market, should a new offering be made available that could add significant competitive

What Is Treasury Management?

- Treasuries are the custodians of cash in a business, they control this through 1) the amount held and 2) its liquidity. The two levers of this are through the sheer size of the balance sheet and the relative stickiness (liquidity) of assets and liabilities held. Their management of this enables the basic fundamentals of an organization: allowing teams to operate and conduct activities by ensuring that there is cash on hand, be it in the petty cash box or an opportunistic M&A raid.

- In addition to enabling business-as-usual (BAU) activities, treasuries partake in the macro-financial direction of a company and oversee the execution of company-wide strategies. For example, if the board decides to buy a business or expand into new territories, Treasury will help to determine the fit of the company from a balance sheet perspective and find the cash (or issue stock) to purchase it ultimately.

- By actively managing liquidity, treasuries ensure that businesses stay alive, save money, and can respond quickly to change.

Areas Covered by a Treasury

- The basics of treasury management can be distilled into five critical responsibilities.

ASSET LIABILITY MANAGEMENT (ALM)

- ALM concerns the blend of assets and liabilities that sit on a balance sheet and the subsequent mismatches between tenor, currency, and interest rate (cost). Companies hold a range of instruments on balance sheets, which behave with varying characteristics. How they interact with each other and represent the overall position could be metaphorically described as being similar to the concept of Beta in portfolio management.

- ALM is most relevant for treasury management in banks because their fundamental purpose is based upon the gearing dynamic of borrowing and lending money. The graphic below demonstrates generic balance sheet compositions for corporates and banks and, as you can see, banks are generally more leveraged through their increased use of liabilities relative to equity capital.

- Because it’s generally cheaper to borrow short-term liabilities and invest in long-term assets, there is a natural tendency for companies to stretch this funding mismatch to a limit. This can all come crashing down during market flashpoints when credit dries up and liabilities become harder to roll. An ALM function monitors this liquidity horizon, prescribing limit buffers and advising on any changes that can be observed in advance.

- Optimizing assets and liabilities in a proactive manner increases profitability and business opportunities. This is not just in the domain of banks; here are some examples of companies using treasury management to assist business:

- Direct to consumer vendors (e.g., supermarkets, eCommerce) that have negative cash conversion cycles and offer consumer credit services.

- Share repurchase schemes enacted at opportunistic periods.

- Factoring receivables to gain a competitive advantage by winning new customers with attractive payment terms.

FUNDS TRANSFER PRICING (FTP)

- Treasuries are mini-banks for their own companies (or banks) and must price up the liabilities on hand for use in everyday asset-generating activities. The FTP reflects the cost of liabilities and is charged to a business unit when it wishes to originate a new asset. Unlike the widely-known cost of debt figure, which can be represented as a standalone loan or benchmark bond yield, the FTP represents a fully-loaded cost. By that, I mean that it is the overall weighted average cost of all liabilities plus the internally shared costs of the business minus treasury profit.

- Funds-transfer pricing is the process of costing a balance sheet and then setting the requisite prices for asset creators or liability gatherers to pay or earn for their respective tasks. Without this, there would be a free-for-all, with profitability and balance sheet structure left to its own devices.

TRADING AND HEDGING

- The responsibilities of hedging company-wide interest rate and FX risk sits with the treasury function, who will use derivatives to balance the books. Depending on the sophistication of the business, these risk management strategies can range up from FX spot trades to long-term interest rate swaps.

- For example, I worked at a bank with predominantly GBP-based liabilities, but with assets written in EUR. A sudden change in either currency would distort the risk, in terms of the proportions of the balance sheet and the relative profitability of deals. To counteract this, we would trade cross-currency swap derivatives to “crystalize” the asset positions into GBP to retain parity.

PORTFOLIO MANAGEMENT

- Treasuries are financial asset managers for their company, investing spare cash that sits on the balance sheet to generate a return (and thus, lower FTP). This is often a very creative exercise that involves the search for yield, liquidity, and capital efficiency. Braeburn Capital, for example, is the asset management arm of Apple, a company that regularly has reserve treasury funds of over $200 billion!

INTEGRATION/PROJECTS

- Overseeing all parts of the business and being agnostic towards any specific business line will usually put the treasury as a useful tool for integrating acquisitions into the company, or for spearheading IT transformation initiatives.

Treasuries Cover All the Bases

- Main argument for treasuries being underrated in organizations is because they are seen as being in charge of all mechanisms that drive financial returns. As such, if managed correctly, they can be a flexible and significant contributor to financial performance.

- Headline attention on business performance does tend towards the income statement side, in terms of revenue growth and profitability. Yet if we take a step back, the core (capitalist) purpose of a business is to provide returns to its shareholders, of which return on equity (ROE) is the standard metric. If we deconstruct ROE into its constituents using the DuPont Analysis formula, it becomes apparent that the role of a treasury touches every aspect of it.

If we look further into these components, we can see the broad role that treasury contributes:

- Net Profit Margin (Profit/Sales): Searching for cheaper borrowing costs increases contribution margin = more competitive

- Asset Turnover (Sales/Assets): Getting more yield out of assets through ALM and portfolio management = more revenue

- Financial Leverage (Assets/Equity): Managing debt to optimal levels = more opportunities

Outside of the C-suite, there are very few teams in a company that can cover all of these bases. Yet, the unheralded treasury team does and thus, if operated correctly, can be a real asset to the company.

Treasury Management Best Practices

Treasuries are underutilized due to them being too reactive and on tunnel vision to follow set processes without the autonomy to be flexible. Below are my treasury management best practices for how to build and operate a capable team, for the benefit of the whole business.

1. Structure and Compensation

Starting right at the top, a business must place its treasury in the correct area of the organization. An effective team must be:

- Impartial: Not allied or biased toward any commercial area of the business

- Empowered: Both in terms of human and capital resources and flexibility to “roam”

- Incentivized: In the absence of being a profit center, team members must have quantifiable goals.

- Too many companies fail by having treasuries as operational offshoots of teams like accounting, working out of a back cupboard in the suburbs. Instead, they should report to the CFO directly and be relied upon as lieutenants in the business for their insight into the balance sheet. Similarly, all roles and functions should be contained within the same team. Trying to create a “cloud team” with roles scattered among the company will ultimately result in crossed wires and less effectiveness.

- Below is a recommendation for key functional roles and focus within treasury teams.

To give an example of why it’s important to contain all of these roles in the same team, here is a simple example of the four pillars working together:

- Operations notices that terms on a lease have been incorrectly interpreted and it’s actually longer.

- Risk models up the effect of the longer asset life and confirms that liquidity horizons have shortened, due to shorter-dated borrowing.

- Relationship managers canvas banking contacts and find a willing lender for a revolving credit facility.

- The investing team drawdowns the loan, using an FX swap to convert a portion to cover short-term requirements.

AGENCY COSTS OF INCENTIVES

- It’s also important from a performance mindset to get compensation and incentives right. This comes optically from how the team is created and to literally where they are seated in the office. Treasuries interface externally, and thus must project confidence and the corporate image to external parties.

- Because the team is not a profit center (profits flow to the central company entity), there can be perverse incentives. For example, taking an ultra high-risk policy of raising long-dated cash and lending it out short term is not a commercially sound practice, outside of severe market stress. But, if the treasury team is not incentivized, they may indeed take this option, because it’s safe and they will get paid regardless. Equally so, because the P&L is just swallowed by the company and performance is not related to it, this can lead to best execution policies going out the door.

- Establishing suitable and compelling incentives for treasury staff reduces agency costs. I believe that variable compensation related to FTP movement is an interesting tool for measuring holistic team performance.

2. Get FTP Right

- Costing up a balance sheet is an arduous task and one that can become difficult if there is a high turnover of items and/or weak IT treasury management systems. Getting it right, though, will ensure that new business activities using the balance sheet are value-additive by ensuring that the mentality of fully-loaded margin is the minds of business units.

- In doing this, having an agreed-upon floating interest rate benchmark (like what LIBOR used to be used for) for the whole company is the best method for pricing up FTP. This removes arbitrage opportunities, interest rate curve risk, and also makes things a lot easier for the ALM team’s monitoring.

- It’s also worth mentioning that FTP should be disassociated from credit risk. Pricing deals should be done on a case-by-case basis by credit/deal teams with counterparties scored for risk and then charged appropriately on top of FTP. This further establishes the agnostic nature of a treasury towards the business: the team is an enabler, not an arbitrator.

3. Communicate Effectively

- As the ears to the financial markets and the straddlers of the balance sheet, the treasury management function is an important news source for the company. It should translate macroeconomic events into resultant risks, or conversely, opportunities. Instead of forwarding information on, such intel should be packaged as actionable insights: “How does this affect our company?”

- Reporting the cash position of a business is a vital end-of-day reporting task, but it should not stop there. Reporting to the executive committee should be communicated in a concise manner, and not just a dump of mundane reports.

When reporting data, focus on key metrics to give a snapshot of:

- Liquidity Horizon: How long you will survive if liabilities stopped rolling

- FTP Cost

- Weighted Average Yield: Earned on assets under your control

- Value at Risk (VAR): Of assets and derivative positions

Using a traffic light system helps to give relativity and emphasize urgency. Equally as important is to give commentary to the data to explain qualitatively why has something changed.

4. Shop Around

- Treasuries are buy-side institutions; they need market makers to provide them with financial products ranging from vanilla deposit accounts up to esoteric derivatives. The key mistake I regularly see here is when a team does not properly shop around and have a wide bench of liquidity providers. Usually, the dealer sticks to a couple of providers, either because they are not proactive enough and/or enjoy the client entertainment that their wide spreads are unwittingly paying for.

- As a footnote to the above, a treasury should interact directly with the market. Going through other teams within the same company is an exercise of P&L pass the parcel and breeds inefficiency.

- An effective treasury should manage external clients in the same way that a sales-focussed SaaS startup would. Maintain a CRM with links into banks, brokers, and funds with rankings of their pros and cons. This will ensure that competitive pricing is achieved and that there is a large phonebook of liquidity providers for when markets go south.

- Electronic trading platforms are great for getting good comparisons on pricing, saving time, and measuring execution performance.

5. Don’t Be a Hero

- The investment portfolios that treasuries manage are the equivalent of the change that you keep in a jar by your front door. This money is money that is left in the pile every day that is not being used. It is white-hot and could be deployed the next day. Investing it is important, though, because the yield gained lowers the dead-weight loss of undeployed capital and can bring tangential hedging and counterparty relationship benefits.

- The three pillars of treasury portfolio management are liquidity, risk, and capital efficiency. These conservative targets are different from most other portfolio managers (notice the absence of yield) and might seem boring to some, but it actually gets quite interesting in the way that you can employ certain instruments in cash management strategies. Yield is an optional fourth choice, but my view is that the opportunity cost of not investing is 0%, thus any yield (positive) is immediately a success.

- We remember poring over Basel III capital rule requirements, at matrices of bond types vs. credit ratings, looking for the highest yielding instrument that would comply with the lowest treasury risk weighting for my bank. For a couple of months in 2012, I became an expert on unloved Slovenian government bonds due to their high yield, yet efficient credit ratings.

- The point is though that no-one will remember the Treasurer that earned a humble 50bp of yield on their investment portfolio, but everyone, including the press, will remember the London Whale who lost $6.2 billion. So don’t be a hero with the cash management process of the liquidity portfolio.

6. Build an ERP and Take the Time to Get It Right

- Treasurers are blind without effective software to splice up the balance sheet and communicate liquidity positions and risk exposures. Money moves by the second and if you are not ahead of this, then you will be chasing shadows trying to reconcile positions. Treasuries need systems that can account for a full range of functionality, the fewer systems the better for ensuring smooth crossover of workflows.

- Treasury software is notoriously difficult to get right. Pre-packaged solutions come with promises but then require constant tweaking to ensure that internal trades and movements get captured. Oftentimes the ERP is a derivative of a trading platform or accountancy ledger software, which can mean that treasury functionality is a compromised add-on.

- Internally-built software can be tailor-made but becomes a mid-term engineering task, my advice is to invest in getting it right and starting from a clean slate. The concept of artificial intelligence seems almost tailor-made for applications in predicting treasury cash flows. This is one big reason why I can see new fintech neobanks having an increasing competitive edge as they scale.

7. Lead Inside the Organization

- A treasury function has the platform of being able to emphasize with asset and liability focused teams, acting as counsel between the two. In banks, this is the deposit takers and lenders, but in a corporate, it could be the property team vs. the payables department.

- Being impartial and involved with the business units and providing solutions over roadblocks will ultimately help the wider organization and increase buy-in.

A Side Note for Treasury in Fintech

- Fintech organizations occupy an interesting niche. They are often at pains to highlight that they do things differently and distance themselves from the incumbents they’re looking to disrupt. One manifestation I see of this trait is the higher emphasis (albeit justified) on technology and marketing, which often leaves treasury relegated to a role in a sprawling function that’s often just named “finance.”

Some general tips for fintechs in this regard:

- Ensure that the first CFO can comfortably wear the “capital markets” hat and the “bookkeeper” hat. This keeps staffing efficient and maintains zen within the financial culture of the startup.

- Get the CTO on board quickly for committing towards a stable roadmap for backend technology. Having a beautiful customer-facing app, but an Excel-based Medusa of an ERP function is a recipe for disaster.

- Focus quickly on building external counterparty relationships. Banks and traditional financial intermediaries may shut the door to a fintech if it fears disruption. The use of partnerships and the magic brand dust of being associated with a fintech can alleviate this, in addition to strategic equity investment partners.

- Tier 2 (“mid market”) banks can be useful allies here, as they are chasing market share and differentiation gains against the entrenched elite.

- Leverage personal links from your VC and angel investors. When a bank smells a future IPO payday, it will offer concessionary services as a way to establish an early relationship and ultimately win capital markets mandates down the line.

- Incorporate pricing analysts into the front and back office. Many fintechs, for example, offer margin-free FX transactions. If this is a straight pass-through of rates achieved from wholesale providers, then that’s fine. But if the company is losing money on these transactions, the cost must be referenced in the overall marketing CAC. Leaving this as the problem of the treasury will result in unrealistic expectations about the unit economics of the business.

Sail the Balance Sheet Ship

For those considering their company’s treasury management function or others considering a career in the area, I often give them these pointers towards its importance in business, in terms of:

- Learning to use the balance sheet as a ship’s sail for driving business growth

- Isolating the effects of real-world events into which parts of the business they effect

- Working toward a macro business goal instead of a micro team P&L

Getting this right will ensure that you have a robust balance sheet that can eke out the marginal gains required to compete in a rapidly-changing and responsive business world.

UNDERSTANDING THE BASICS

What is treasury management and its functions?

- Treasuries oversee five core areas: (1) asset liability management (ALM), (2) trading and hedging, (3) portfolio management, (4) funds transfer pricing (FTP), and (5) company-wide integration projects.

Why is asset/liability management important?

- Managing the size and relative liquidity of a balance sheet is critical for both lowering the risk of not having enough funds to operate and to increase the competitiveness of the business through its cost of funds.

Why is treasury management important?

- Treasuries manage the balance sheet of a business and enable its functions to run smoothly. By optimizing liquidity and cost of capital, it actually has a core role in increasing return on equity and driving shareholder returns.

- Demands on the corporate treasurer are changing, and many are struggling to keep up. Here’s where to start.

Five steps to a more effective global treasury

- The cost can be heavy. Companies pay incremental interest expenses when they overborrow as a result of inaccurate cash flow forecasting and often lose money when they don’t hedge exposures for currencies and for interest rates, commodity prices, or both. They pay unnecessary taxes when cash moves needlessly through tax-heavy regions. If inadequate controls or segregated financial responsibilities lead to fraud, companies face both financial losses and reputational damage. Those that miss their financial covenants with banks or fail to meet liquidity requirements can find themselves dealing with credit-rating downgrades, a loss of credit flexibility, or even bankruptcy.

- In an effort to help corporate treasurers improve their performance in core activities, we surveyed 120 of them over the past year and conducted in-person interviews with an additional 50. Those sources, as well as our experience working with treasurers, have led us to believe that companies should focus on five moves to improve their global treasury function.

1. Centralize the treasury function globally

- Historically, most companies have had a treasury department at their corporate headquarters, but it was “siloed,” managed only core activities, and often duplicated those of individual business units. As bank communications technology improved and treasury groups added new responsibilities, it made sense to consolidate functions that had been operating independently in different parts of the world.

- Many companies did centralize treasury functions at headquarters, supported by a few part-time treasury and finance professionals in developing markets. But most treasuries retain too many decentralized components, and few are as centralized in developing markets as they are in developed ones. Our survey found, for example, that among global companies operating in over 50 countries, the average number of bank accounts held was more than 850 — considerably higher than the 200 or so we’ve seen at the best performers. One treasurer we interviewed complained that her company didn’t even know how many bank accounts it had overseas. And at one heavy-materials company, analysis of cash balances in 300 accounts held by 25 country locations showed a daily average of over $80 million in uninvested cash over a three-month period.

- The ideal model would centralize policy setting, decision making, and execution — though not necessarily personnel. Consolidating the treasury function under the global treasurer can help by giving managers an aggregate view of their cash flow and risk positions — a view they need to optimize debt and investment portfolios and to minimize taxes and financial risk. Moreover, the operating model and infrastructure that connect a company’s various activities, portfolios, and risks ensure that even regional treasury groups have the quickness and rigor needed to make the most of activities in volatile markets. They can therefore take advantage of local financial opportunities and avoid unnecessary losses. Such a treasury would have to be flexible and well controlled to receive inputs from regional treasuries.

- One caveat: a centralized treasury organization does come with trade-offs; for instance, it might leave a company with less information about local banking and country-specific regulations. Moreover, business units in different regions may have to cede responsibility for activities, such as currency and commodity hedging, that have historically benefitted their local profit-and-loss statements. That can generate resistance from local managers. At one of the world’s largest consumer goods companies, for instance, the CFO would like to eliminate duplicate treasury functions among businesses and centralize the treasury in one location. But doing so would require a battle with strong, independent businesses that adamantly defend their own treasury infrastructures and back-office locations.

- Such battles are winnable. One global company, for example, upgraded its treasury in Asia to the same level as those in established markets by designing improvements to its operating model to take effect as the treasury function matured over a five-year period. Here the emphasis was on analytical sophistication, internal-client impact, automation, and integration.

- The company’s treasurer organized a structured workshop, bringing everyone to a single geographical location free of operational distractions, to get buy-in from the global treasury managers and ensure that the treasury’s mission and operating model were aligned with the company’s mission and strategic plan. The CFO approved investments in new systems for cash management and for the front and back offices. The development of treasury policies and a treasury “dashboard” kick-started the initiative and extended the company’s treasury capabilities to its regional businesses. Managers are pleased with the progress of this redesigned treasury, though the CFO reports that it’s still struggling with the reporting relationships between the global treasurer and the management of regional business units.

2. Strengthen governance

- Wherever there’s money moving around, fraud and mismanagement are risks. That’s particularly true in a company’s treasury department, where funds move in real time, using complicated financial instruments — and where an erroneous transaction can affect accounting, financial reporting, and internal controls. Add regional differences in protocols, governance, and oversight norms, and the problem can be a real headache for CFOs and treasurers alike, especially as their companies expand into some developing markets where governance is often weak or nonexistent.

- Strengthening treasury governance requires a thorough review of policies and processes for core activities, followed by testing to ensure that they work well in practice and by comprehensive training. One way to start is to test how processes work under stress. The treasurers we identified as most effective, for example, regularly test the business continuity plans that keep treasury operations running through unforeseeable catastrophic events, such as the recent hurricane on the US East Coast, the 2011 tsunami in Japan, or the 2001 terrorist attacks on the New York World Trade Center.

- In our experience, such plans should be — but often aren’t — tested regularly in all regions to highlight and correct operational-risk weaknesses. Unannounced tests are critical. The global treasurer at a US-based conglomerate, for example, woke up his direct reports with a 5:00 AM telephone call announcing a simulated disruption to normal activities and setting in motion a series of tests. These tests helped the function develop operational readiness and the ability to access and transact in markets, with no “leakage.” Ideally, treasury operations would appear undisrupted to senior management.

3. Enhance treasury-management systems

- The rapid pace of software development over the past 20 years has brought to market a range of sophisticated tools that facilitate the treasury function. The conundrum has been that the earliest tools — spreadsheet programs — have dramatically improved. Some CFOs are not convinced that advanced systems are worth the cost, which can run as high as $1 million or more for integrated treasury-management systems and enterprise-resource-planning (ERP) modules. In our survey, we found that nearly half of the companies with less than $10 billion in revenue still used spreadsheets as their primary treasury system.

- Yet cost–benefit analyses are unreliable in this case because it’s difficult to measure the value of risk avoidance, a unified database, automation, integration, and enhanced management reporting. Quantifying the value of stronger governance, internal controls, and better analytical tools is a challenge, too. And spreadsheet programs, powerful though they may be, are woefully inadequate for a centralized global treasury. They’re seldom well controlled, and few companies audit them closely enough to validate the logic of interconnecting calculations or even the formulas in individual cells. A single error in a single cell can ripple through an entire model, leading managers to borrow instead of invest, to hedge incorrectly, and to forget to fund operating accounts or to make debt payments.

- And often there’s no integration: we continue to encounter treasurers whose management system includes as many as 50 or 100 distinct spreadsheets, often reflecting different systems used by businesses in different geographies. That approach can lead to unnecessary hedge transactions when managers unintentionally hedge exposures in different regions against each other, instead of aggregating the longs and shorts of currency exposures and then hedging the net position.2

- Even minor errors can cost a company many times the expense of a more sophisticated treasury-management system. At one North American utility company, for example, a simple spreadsheet error for energy auction bids led managers to enter into nonreversible contracts the company didn’t need — a mistake that cost it half of its operating earnings for the quarter. At an agrochemicals company, a simple data entry error led the US treasurer to wire $80 million inadvertently to the wrong payee in the wrong country. By the time managers discovered the error, currency rates had shifted, and returning the cash came at a substantial cost.

4. Increase the accuracy of cash flow forecasting

- Treasurers often admit that their global cash flow forecasts are poor or incomplete. The CFO of one international airline, for example, noted that when his company recently ordered new airplanes, it had no cash flow forecast — and no idea if it could pay when the time came. If it couldn’t, the airplane manufacturer would stop delivering planes, hobbling the airline’s growth. That’s an egregious example, to be sure. Yet in our survey, nearly one-half of the treasurers reported that their cash forecasting was less than 80 percent accurate.

- Improving the accuracy of forecasts isn’t rocket science; it just requires a robust set of activities that companies don’t or can’t undertake. A company’s treasury function should aggressively analyze cash flow forecasts and different cash scenarios, consult with the company’s businesses in all global regions on how they might best utilize cash economically, run currency “what if” scenarios, and provide a multinational company with better intelligence for the use of cash.

- An effective program also acts as an early-warning system to anticipate potential liquidity gaps, which are a primary source of financial risk, particularly in emerging markets. Liquidity forecasts, measuring liquid assets and credit sources to predict whether a company will be able to pay its debts and obligations, can help it manage cash by testing stress scenarios for differing market conditions. The daily, weekly, and monthly monitoring of cash in all business regions helps treasurers keep track of progress; for example, it ensures that they have the information needed to decide which cash pools and funding options they should pursue to avoid a cash shortfall and lets them measure the impact of efforts to improve cash flow performance.

- Here again, an advanced treasury system is a powerful tool. But as with all technological solutions, it can’t fix variances in global cash flow forecasts or automate the process completely. Cash flow forecasting is a structured and iterative process that requires treasurers to seek input from the field and various business locations.

5. Manage working capital in developing markets

- The concept of working capital seems like a simple one: current assets minus current liabilities equals the capital that a company uses in its day-to-day operations.

- Yet managing working capital globally is a challenge, especially in developing markets, where the task can be complicated by differences in business culture. Payment terms, for example, may vary markedly — from the 30 days common in many developed markets to as much as 360 days in some South American and African countries. A lack of automated systems to process accounts payable and receivable introduces further complexity.

- Moreover, many companies in both developed and developing markets focus too closely on accounting-type measures, such as the cash flow statement or the profit-and-loss statement, without developing discipline in cash and working-capital management. That emphasis misses the real workings of a company and deflects attention from the fundamental principles of optimizing cash. The CFO of a business unit in a global industrial company, for instance, recognized the progress of his treasury’s efforts to reduce working capital in accounts payable and receivable. But he also stressed that efforts to improve inventory still needed to encompass the entire cash conversion cycle.

- Many executives are surprised to find that their companies hold excessive levels of working capital in regions where they aren’t established. Managing working capital is complicated because it requires spending a lot of time with business units in their various regions to understand how they pay their suppliers and figure out customer behavior. It’s not an easy task. Yet many treasurers find it a useful way to raise their profile and distinguish themselves as strategic financial advisers to the organization. Indeed, two-thirds of the treasurers in our survey reported seeing working-capital management as an opportunity and would like more involvement in it.

- As companies assign new responsibilities to the corporate treasury function, treasurers must improve it with a global focus and streamline its performance. That may require an up-front investment, but the payback is worth it.