- After successfully becoming a zero-net-debt company this year by selling stakes to the likes of Facebook and Google in Jio Platforms, Reliance Industries Limited (RIL) is now looking to do the same with Reliance Retail and its oil-to-chemicals business.

- https://bit.ly/3n5LO8l

- RIL is seeking to entice Facebook and KKR, both early bird investors in Jio Platforms, to buy into Reliance Retail. As for the oil-to-chemicals business (O2C), plans are already afoot to hive it off into a separate company styled Reliance O2C, which will include all the refining, petrochemicals and related manufacturing and retail marketing assets, but minus the oil exploration business.

- Reliance Industries Ltd. will turn largely into a holding company with stakes in different businesses — refining and petrochemical, retail, telecom and media. The Mukesh Ambani-controlled conglomerate will be left with only the domestic oil and gas exploration arm in its standalone business, while all the other units will be held through structures similar to subsidiaries. That will happen after Saudi Aramco will be given the 20 percent stake, while the remaining 80 percent will be held by RIL’s current shareholders.

- Watch out for more Oil and Gas assets acquisition announcement….

- Since the lockdown started, Reliance Industries has seen its market cap double from $100 billion to $200 billion. In 2020, its stock has had a dream run, with Rs152,056 crore raised by Jio Platforms. On September 9, Reliance Retail announced a Rs7,500 crore investment by Silver Lake Partners for a 1.75 percent stake valuing the business at 4.21 lakh crore.

- On September 10 2020 came news that Reliance Retail may do a $20 billion deal with Amazon for a stake sale in its retail business, sending the share prices up 7.1 percent to Rs 2,314 per share, and taking its market cap past the $200 billion mark.

- As of today, Reliance Industries’s enterprise value is $230 Bn EV-to-EBITDA of 22.66 and PE Ratio of 37.20.

- So, what has made the New Rejig of RIL portfolio a darling of investors?

- It is multiple revenue streams from the same user base. But a larger trend here is the network effect and of course state of the art financial engineering. According to a recent report by Bank of America Global Research, from a monetisation perspective for super-apps across Asia, the focus is moving towards payments and commerce rather than just ads.

- Jio Infocomm alone, on the other hand, is capex heavy, and has a linear revenue model so it does not offer much in terms of valuation.

- Read more about this game changer.

Competitive Comparison

- Competitive companies are chosen from companies within the same industry, with headquarter located in same country, with closest market capitalization; x-axis shows the market cap, and y-axis shows the term value; the bigger the dot, the larger the market cap.

Reliance Industries EV-to-EBITDA Distribution

- The bar in red indicates where Reliance Industries’s EV-to-EBITDA falls into.

JIO Platforms

- RIL’s dealmaking and financial engineering lured about $20 billion of investments from Google to Facebook Inc. and others into its digital JIO Platforms in recent months by divesting nearly 33 per cent stake in Jio Platforms to an eclectic mix of 13 investors. Behind this goes a meticulously planned financial engineering exercise that only RIL could have drawn up which is being extended into Retail and O2C as well. Smart deal structuring helped them achieve multiple objectives Between April 22 and July 15 this year as we announced the largest, fastest fund-raise so far in India Inc — more ₹1.5-lakh crore through a stake sale of about 33 per cent in its subsidiary Jio Platforms to 13 marquee foreign investors.

Groundwork

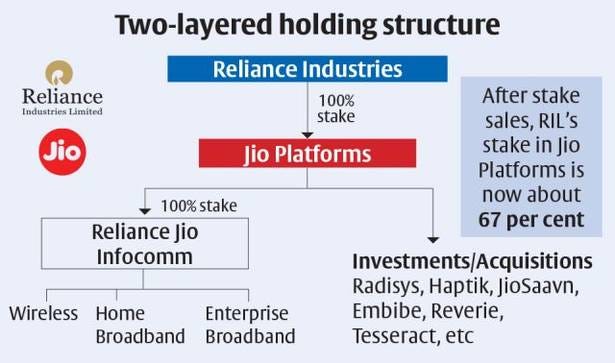

- The groundwork for the mega stake-sale was set into motion in the latter part of the last year — when Jio Platforms was established as a holding company to house all of RIL’s digital businesses.

- This included the flagship Reliance Jio Infocomm (RJio) that has rapidly risen to a position of dominance in the country’s telecom sector. RIL set up Jio Platforms as a wholly-owned subsidiary, which, in turn, held full or majority stakes in several digital businesses including RJio (see chart). So, when investors bought a part of Jio Platforms, they got a part of RIL’s entire digital business as well.

- The key objective behind this two-layer structure was to set up an integrated, digital business entity that was light on debt — one that could command top-dollar valuations, similar to global tech majors. RIL had invested big money in its digital businesses, a good part through debt, and it needed handsome payback to de-leverage its books.

Capital Re-organisation

- The ingenious capital re-organisation was also a complex one involving RIL, Jio Platforms and RJio. While there are many scenes in the act, here’s the key one.

- RIL took over a chunk (about ₹1-lakh crore) of RJio’s debt, but along with it, RJio also gave RIL an equal amount of consideration, read cash. Nice, but how did RJio get the cash? That came from Jio Platforms, when it subscribed to the OCPS (Optionally Convertible Preference Shares) issued by RJio.

- OCPS are quasi-equity instruments. But how did Jio Platforms get the cash to subscribe to the OCPS of RJio? Well, that came from RIL when it subscribed to the OCPS issued by Jio Platforms. Net-net, RIL used its cash to finance Jio Platforms, which used the cash to finance RJio that, in turn, transferred the cash back along with the debt to RIL. So, effectively RIL took over the chunk of the RJio debt and got back its own cash, with Jio Platforms being the go-between (see chart).

Stake sales

- Now, to monetise its digital businesses and also pay down the increased debt on its books, RIL decided to sell stakes in Jio Platforms. The sale kicked off in late April this year when Facebook came on board, buying 9.99 per cent in Jio Platforms for ₹43,574 crore. Of this, Jio Platforms will retain ₹14,976 crore and the balance ₹28,598 crore will go towards redeeming the OCPS held by RIL in Jio Platforms.

- For subsequent stake sales, too, a portion — 10 per cent — has been retained in Jio Platforms, while the rest has gone to RIL by redeeming the OCPS held by it in Jio Platforms.

Tax Free Raise

- The stake sale happened at top-dollar valuations. Interestingly, neither RIL nor Jio Platforms will be paying any tax on the stake sales, thanks to some smart deal structuring.

- Jio Platform’s total equity as of March 2020 comprised equity share capital (₹4,961 crore) plus other equity (₹1,77,064 crore). This ‘other equity’ was optionally convertible preference shares (OCPS) issued to RIL. It was earlier believed that when investors bought stake in Jio Platforms, they were given equity shares by converting the OCPS held by RIL. So, the amount of OCPS would have reduced while the share capital increased, keeping the total equity the same. Thus, dilution of earlier shareholders (except RIL) did not happen when shares were issued to new investors. Ergo, the stake sales seemed to have been structured as a transfer of shares from RIL .

- But this arrangement would have left RIL liable to pay capital gains tax as it would have sold equity shares converted from the OCPS that it held in Jio Platforms to the investors at a premium. The gains on such transfer of securities would have been categorised as short-term (taxed at the highest applicable rate, in excess of 30 per cent), given that Jio Platforms was incorporated only late last year.

- The potential tax pain seems to have been avoided by a simple method — fresh issue of shares by Jio Platforms to the various investors. To Facebook, the first investor, and also a strategic one, Jio Platforms issued both equity shares and 0.01 per cent CCPS (compulsorily convertible preference shares) at ₹488.34 per share. Google, the latest investor and also a strategic one, was issued equity shares at the same price — ₹488.34 apiece. All the other investors were issued equity shares at a higher price — ₹549.31 a share. With these total share proceeds of ₹1,52,318 crore, Jio Platforms redeemed OCPS worth ₹1,29,046 crore held by RIL and retained ₹23,272 crore with itself(see table for break-up).

One stone, many birds

- This fresh issue of shares by Jio Platforms helped kill many birds with one stone. RIL got repaid a chunk of its OCPS, thus reducing its own net-debt position significantly. The redemption of OCPS held by RIL is essentially repayment of funds earlier infused by RIL into Jio Platforms, and will not attract tax. Jio Platforms could retain a portion of the funds for its own purposes. Since it was Jio Platforms that issued the shares, RIL will not have to pay tax on the stake sale. Jio Platforms, too, would not have to pay tax though it issued shares at a tidy premium — that’s because the pricing of the shares took into account their fair value based on the report of an independent valuer. Even if the shares’ sale price was higher than the fair value, the tax law provides concessions if the buyer is a non-resident investor. In case the shares are issued at a price which is higher than the fair value, then the amount in excess of the issue price over the fair value, is deemed to be income in the hands of the issuing company per Section 56(2)(viib) of the Income Tax Act. However, this provision is not applicable when shares are issued to non-residents (this would include foreign institutional investors and strategic foreign investors). As such, when shares are issued by the company to non-residents investors, there is no tax liability for the issuing company on this account.

No dilution of investor stakes

- But when fresh shares were issued to new investors, how did the shareholding of the earlier investors not get diluted? This is where a specific provision in Jio Platform’s altered Articles of Association (AOA) comes in: “No dilution of any shareholder (other than RIL or any of its permitted transferees) shall occur as a result of any permitted share transaction (after taking into account the redemption and/or conversion of any OCPS in connection with such permitted share transaction).”

- In the amended AOA, permitted share transactions comprise ‘incremental equity financings’ and ‘conversion share sales’. The former refers to fresh issue of shares to new investors while the latter refers to shares issued to new investors by conversion of OCPS held by RIL. Jio Platforms seems to have opted for ‘incremental equity financings’.

The start-up model

- Also, Jio Platforms seems to have opted for a fund-raising model adopted by many start-ups that raise capital from a series of investors within a time window. In this model, a company agrees with investors that a particular number of shares, eventually representing a certain percentage of the fully diluted share capital, will be allotted to them at the end of the fund-raise from multiple investors. Also, adjustments, if necessary, are made to the capital structure to maintain the agreed shareholding of investors.

- This way, earlier investors do not get their stakes diluted when new investors are brought in. In the case of Jio Platforms, though the deals with the different investors were announced on various dates, the shareholder resolutions for the allocation of shares to all the investors were passed on July 6, 2020.

- RIL and Jio Platforms in their June quarter results releases said that after completion of these investments, RIL would hold 66.48 per cent in Jio Platforms which corraborates with the documents on the MCA website.

OCPS conversion to equity

- Interestingly, the shareholding of the previous investors in Jio Platforms did not get diluted when new investors came in; only the shareholding of RIL in Jio Platforms kept reducing.

- Jio Platform’s total equity as of March 2020 comprised equity share capital (₹4,961 crore) plus other equity (₹1,77,064 crore). This ‘other equity’ is OCPS issued by Jio Platforms to RIL.

- When the many investors bought stake in Jio Platforms, they were given equity shares by converting the OCPS held by RIL. Due to this adjustment, the total share capital base did not increase, and dilution of previous shareholders (except RIL) did not happen when shares were issued to new investors. The amount of OCPS reduced while the equity share capital increased, keeping the total equity the same.

- Essentially, the stake sales seem to have been structured as a transfer of shares from RIL.

- But some money being retained at Jio Platforms suggests a Jio Platforms issuing to investors its own treasury shares (if it had them), or Jio Platforms getting funds from RIL in the form of debt or redeemable preference shares which will be clarified in next Annual Report or an IPO of Jio Platforms, whichever happens earlier.

Reliance Retail

- After Reliance Industries Ltd (RIL) raised a record 1.5 trillion INR by selling stakes in Jio Platforms Ltd (JPL), expectations have been running high with regard to stake sales in the group’s retail venture. RIL stock price at the current level of ₹2,244 is likely pricing in a $65–80 billion value for Reliance Retail.

- Using the valuation of this deal in retail (US$65bn), recent deal in Jio Platforms (EV of ~US$90bn) and proposed deal with Saudi Aramco (EV of US$75bn) and adjusting for the minority interest in Jio (33.5%) and retail (5.6%) gives us an equity value of US$210bn. This is very close to the current market cap excluding the value of treasury shares.

- The fallback is the so-called optionality of RIL’s technology businesses such as JioMart and a much-awaited superapp. Analysts at JP Morgan now value this optionality as high as $65 billion. However, these businesses are already housed in RRVL and Jio Platforms respectively and the valuations of the two firms already capture this optionality.

- Indeed, Jio Platforms was valued at multiples much higher than peers such as Bharti Airtel Ltd and the reason given for this was that investors have attributed the difference to the option value of the Jio superapp. However, the fact that the JioMart optionality has not added much value to Reliance Retail comes as quite a disappointment.

- Stock market investors, flush with liquidity, will perhaps conclude that private market investors such as Silver Lake have not fully appreciated the huge value that the e-commerce businesses can throw up. That’s a foolhardy assumption, given that large private equity investors have access to better investment tools, and more information.

- Another hope is that the Silver Lake transaction will be followed up by a strategic investment announcement. The key will be whether Reliance Retail is able to attract strategic investors (global retailers and e-commerce companies that are competing with Reliance Retail in India), which could drive re-rating on expectations of reduced competition for Reliance Retail. Whether these expectations play out or not remains to be seen. For now, the fundraising spree at RIL puts it in a strong position vis-à-vis competition in the telecom, retail and e-commerce segments.

Reliance Oil-to-Chemical Business Spinoff Plan

- RIL has started work on hiving off the oil-to-chemical (O2C) business into a separate unit for a possible stake sale to companies such as Saudi Aramco.

Reliance O2C Ltd will house

- Oil Refining and Petrochemical Plants and manufacturing assets

- Bulk and Wholesale Fuel Marketing

- RIL’s 51% interest in Retail Fuel Joint Venture with BP of the UK.

- RIL’s Singapore and the UK-Based Oil Trading Subsidiaries / Marketing subsidiary.

- Reliance Industries Uruguay Petroquimica SA.

- Reliance Ethane Pipeline Ltd that operates a pipeline between Dahej in Gujarat and Nagothane in Maharashtra.

- 74.9% stake that RIL holds in the joint venture with Sibur.

Reliance O2C Ltd will not house

- RIL’s Very Large Ethane Carriers.

- Gas Pipelines such as one that transports coal-bed methane from its CBM blocks.

- Overseas Oil and Gas Asset Holding Company Reliance Industries (Middle East) DMCC.

- Domestic Exploration and Production Assets.

- RIL’s textiles business as operated out of the Naroda site.

- Baroda township and land, including cricket stadium.

- Jamnagar power assets, and Sikka Ports and Terminals Ltd .

RIL values the O2C business at $75 billion and has been in talks with Saudi Arabian Oil Co (Aramco) for sale of a 20% interest.

- The nature of risk and returns involved in the O2C business are distinct from those of the other businesses of RIL and the O2C business attracts a distinct set of investors and strategic partners. RIL has been exploring various opportunities to bring in strategic/other investors in the O2C business. Investors have expressed interest to make an investment in the O2C business. The process of spinning of O2C into a separate subsidiary would be completed by early 2021.

- RIL owns and operates twin oil refineries at Jamnagar in Gujarat, with a combined capacity of 68.2 million tonnes per annum. It is also the country’s largest petrochemical manufacturer with units at Jamnagar, Dahej, Hazira, Nagothane, Vadodara, Patalganga, Silvassa, Barabanki, and Hoshiarpur.

- The refineries, as well as the petrochemical plants, would now be housed in Reliance O2C Ltd & the ultimate ownership won’t change as a result of the plan. The company holds a 66.6% stake in the KG-D6 block where it is investing about $5 billion in developing a second set of gas discoveries along with BP. It also has a similar stake in the NEC-25 block in the Bay of Bengal and operates two CBM blocks in Madhya Pradesh. These upstream assets would not be transferred to the O2C unit.

Redeployment of billions from Jio stake sales into debt funds

- RIL is delaying billions into Indian debt funds after receiving cash from stake sales and a rights issue. The monies have been deployed into ultra-short and money-market funds, and others focused on debt with an average of three-to-five year maturities, according to fund managers who asked not to be identified in discussing investment details. The monies have been deployed into ultra-short and money-market funds, and others focused on debt with an average of three-to-five year maturities.

Rupee flows

- The deluge of Reliance-related money pouring into the nation in recent weeks, which helped the rupee advance more than 1% in the past month to become Asia’s best-performing currency.

- In June, RIL became free of net debt after selling stakes in Jio Platforms Ltd., its digital unit, its energy business, as well completing a rights issue.

- The Reliance money is for longer-term investment, and isn’t just parked with the funds, but a bet on the interest-rate cycle with its investments

Giant in markets

- The fund flow is adding to the rally in short-duration bonds, with banks and investors also jumping into such debt amid expectations for more rate cuts by the Reserve Bank of India. The 5.22% 2025 bond yield has dropped 19 basis points this month, more than the eight basis points decline in the benchmark 10-year yield.

- Reliance’s influence in the financial market has in the past also drawn attention. Last year, the company and a unit accounted for more 60% of a currency swap auction held by the central bank. Back in 2017, it dropped more than 70 billion rupees into funds betting on interest-rate declines.

Network18 — Consolidation Of Media & Distribution Businesses

- India’s largest listed Media Company RIL is consolidating its media and distribution businesses under one entity — Network18 Media & Investments Ltd. This is the next big thing for RIL.

Network18 Media & Investments Ltd — India’s Largest Listed Media Company

- Reliance Industries Ltd (RIL) announced a consolidation of its media and distribution businesses spread across multiple entities into one entity — Network18.

- Under the Scheme of Arrangement, TV18 Broadcast, Hathway Cable & Datacom and Den Networks will merge into Network18 Media & Investments.

- The appointed date for the merger shall be February 1, 2020.

- The broadcasting business (TV18 Broadcast) would be housed in Network18, while the cable and distribution business (Hathway Cable & Datacom and Den Networks) would sit in two separate wholly owned subsidiaries of Network18.

Network18 Group — Business Outlook

The major key businesses of Network18 group is shown above.

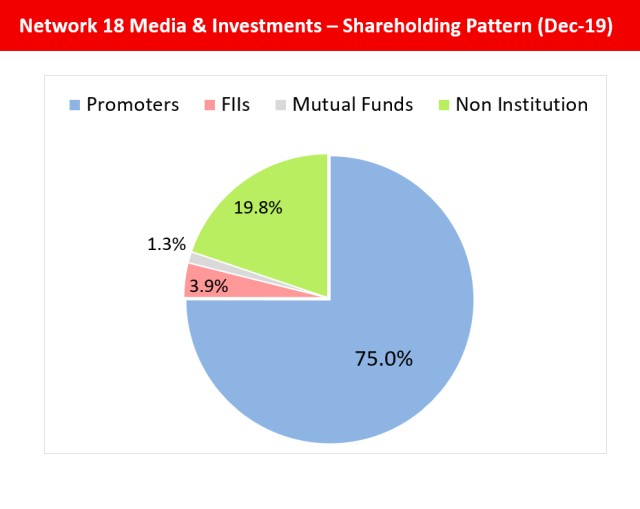

Network18 — Shareholding Pattern (Dec-19)

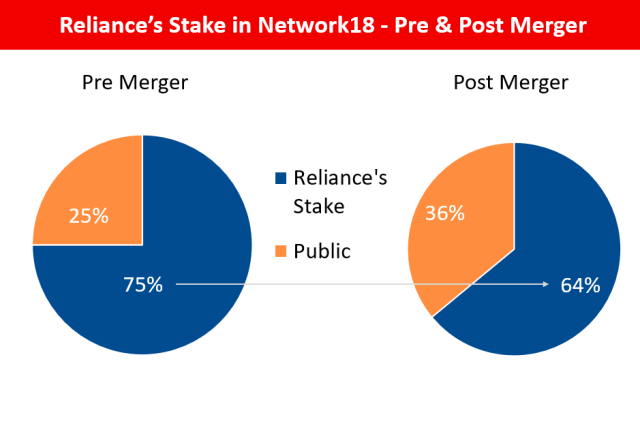

- Earlier, before the consolidation, the shareholding pattern of Network18 Media 7 Investments was as above. Here, the promoters group — Reliance Industries was holding a stake of 75%.

- % holding of FIIs, Mutual Funds and Public were 3.9%, 1.3% and 19.8% respectively.

- Reliance Industries Ltd’s stake in Network18 would reduce to 64% from 75% after this merger.

Share Exchange Ratio

- 92 shares of Network18 for every 100 shares of TV18

- 78 shares of Network18 for every 100 shares of Hathway Cable & Datacom

- 191 shares of Network18 for every 100 shares of Den Network

Benefits of Consolidation of Media & Distribution Businesses into Network18

- In November, Japanese major Sony Corporation had initiated preliminary talks with Network18 for a possible stake buy, making it the second attempt by Sony in a year to seek local acquisition.

- It had earlier sought to acquire stake in Zee, but had failed to do so.

- The merger of RIL’s media and distribution businesses into Network18 would create an ecosystem for growth opportunities in digital, broadcast media, cable, and broadband.

- The restructuring shall create value-chain integration in the overall consolidation of Media and Distribution businesses. The scheme will also simplify the corporate structure of the group by reducing the number of listed companies.

- Also, as a result of this consolidation, Network18, which is one of India’s largest listed media companies, will become an entity with about Rs.8,000 Crore in annual revenue and benefit from substantial economies of scale.

- The combined broadband entity will also serve one million wireline broadband subscribers across the country. Besides, shareholders of all the four companies will also benefit from streamlining of operations and strategy, focused management, and reduction of risk through consolidation.

- An integrated media play shall further increase the breadth as well as depth of the group’s consumer touch points and benefit from capturing entire subscription revenues within Network18 which was earlier spread between broadcasting and distribution entities.

- The merged entity will be net debt free (at the consolidated level) and can allocate free cash flow to the businesses as and when required. It can also provide a base for growth and better shareholder returns.

- This might also bring the company closer to bringing a strategic investor or Private Equity to provide value unlocking to Network18.

OVERALL RIL BUSINESS CONSOLIDATION & FUTURE EVOLUTION

- Reliance Industries Limited www.ril.com ( RIL ) is a 230 Bn USD by marketcap.

- RIL is a Fortune 500 company and the largest private sector corporation in India and has has 600,000 employees worldwide.

- Portfolio Of Businesses — We have evolved from being a textiles and polyester company to an integrated player across energy, materials, retail, telecom, entertainment and digital services.

- Energy / Material

- Oil & Gas Exploration & Production

- Reliance is one of the largest exploration and production players in India having a balanced domestic conventional and unconventional hydrocarbon portfolio.

- With an investment of 8.5 Bn USD Reliance’s upstream joint ventures in US Shale gas include a 45% working interest (WI) partnership with Ensign Natural Resources in the Eagle Ford shale play and a 40% WI partnership with Chevron.

- Refining & Marketing

- Refineries

- Petroleum refining and marketing (R&M) is the second link in Reliance’s drive for growth and global leadership in the core energy and materials value chain.

- RIL operates World’s Largest Refineries processing 1.5 Million barrels per day.

- Refined Fuels

- Fuels — 1380+ retail outlets. 5000 more planned.

- Lubricants — 100+ distributors and 12000+ dealers

- LPG Gas — 2300+ distribution outlets.

- Aviation Turbine Fuel — Serving 30 airports in India.

- Petrochemicals

- Polymers- One of world’s largest producers of polymers with an annual production capacity of 5.4 Million Tonnes.

- Aromatics- One of world’s largest producers of aromatics with annual Production 6 Million Tonnes.

- Elastomers — World’s largest synthetic rubber manufacturer with annual production capacity of 1.3 Million Tonnes.

- Fiber Intermediates- World’s Largest Manufacturer with annual production capacity of 6.5 Million Tonnes.

- Polyester- World’s Largest Manufacturer with annual production capacity of 2.5 Million Tonnes.

- Fiber Composites- One of world’s largest manufacturer with annual production capacity of 2.5 Million Tonnes.

- New Energy & Materials — This new energy business based on the principle of carbon recycling and circular economy is a multi-trillion opportunity for India and the world

- O2C- The company intends to approach the National Company Law Tribunal with a proposal to spin off its oil-to-chemical (O2C) business into a separate subsidiary to facilitate this partnership opportunity.

- BreakThrough Energy Ventures- RIL owns 5.75% of BEV which seeks to find solutions to the climate crisis by flexibly investing to develop breakthrough energy and agriculture technologies.

- Algae To Oil -Reliance synthetic biology programme, comprising 150+ scientists and researchers, recently developed an “algae to oil” technology that takes carbon dioxide waste from the refinery, and combines it with algae and sunlight to produce bio-crude oil that could one day fuel the carbon-neutral air travel.

- Algenol — Micra Algae Cultivation / Growing Systems and Genetic Engineering.

- AlgaeTec- Micro Algae Processing Systems.

- Aurora- Micro Algae Cultivation / Growing / Processing Systems.

- Giga Factory-Reliance is mulling Lithium-ion Battery manufacturing Gigafactory in India.

- Hydrogen Fuel- Reliance to replace auto fuels with electricity, hydrogen; targets carbon-zero company by 2035.

- Textiles

- Our textiles manufacturing division at Naroda houses one of the largest and most modern textile complexes in the world, an achievement recognised by The World Bank.

- We supply premium finished fabrics to prestigious brands and export to over 58 countries.

- We are also a major player in global automotive furnishing business.

- Only Vimal Retail Brand — One of the largest manufacturers with annual capacity of 25 Mn meters of fabric and apparel. The showrooms are one roof destination of complete range of suiting and shirting fabrics and bespoke experience. The ready to wear range offers shirts, trousers, suits, blazers, causal tees and accessories.

HealthCare

- PPE- In short RIL supplies all the plastics, polyester and rubber needed for manufacturing PPEs for the last 40+ years since our incorporation. RIL also manufactures PPE ( Gowns and N95 being exported now. Other PPEs cannot be exported due to govt restrictions ).

- Life Sciences

- Life Sciences- One of the largest globally Reliance Life Sciences is a research-driven organization developing business opportunities in bio-therapeutics (plasma proteins, biosimilars and novel proteins), pharmaceuticals (later-generation, oncology generics), clinical research services, regenerative medicine (stem cells therapies), cord blood repository, stem cells repository and molecular medicine.

- Diagnostics- Has developed our own tests ( molecular , antigen, antibody ). RIL is the first firm in the world to bring RT-LAMP test.

- Vaccines- RIL life sciences has been licensed for manufacture of COVID19 vaccines.

- Hospitals

- Largest and Most Modern Quaternary Hospital Chain with a country wide network of tertiary, secondary and primary medical outlets.

- HealthTech- With a series of acquisitions in the healthcare space, including Karexpert, C-Square and Netmeds, RIL will eventually integrate its brick-and-mortar presence in the segment with its tech-enabled offerings to create a bouquet of services that can be monetized through delivery, transaction-based services and subscription services.

- E-pharmacy — With a dynamic legacy of over 100 years in the pharma business, it comes as no surprise that Netmeds.com is the first choice of over 4 million+ satisfied customers when it comes to an online pharmacy in India. Netmeds.com has a pan India presence as we deliver health care essentials to every state in the country. We take your health seriously at Netmeds.com. Be it purchasing medicines online, lab tests or online doctor consultations, we’ve got it all covered for our customers!

- HealthConsult- India’s first digital healthcare open network, with cloud-based technologies for healthcare providers and multiple mobile/web applications for all stakeholders and patients.

- HealthCompanion- Your complete health companion Book tests, consult doctors, manage your weight & much more. Access reports & securely share them with your doctor.

- Pharmacy Management- Provides all-encompassing, comprehensive solutions to the entire pharma ecosystem. Our solutions are a preferred choice for pharma marketers, C&F, distributors and retailers providing holistic business process automation system.

- Smart Cities — Largest grassroots smart city developer.

- Mega Cities- Mega Cities with 10 Mn population and 75 Bn investment per city.

- RIL holds 34 per cent in EIH, One of the largest hotel owner / operator. which it holds via Reliance Industrial Investment & Holdings.

- Oberoi — Owns and operates 31 luxury hotels and two river cruise ships in 5 countries.

- Trident — Owns and operates 10 luxury hotels in India.

- Maidens — Situated in the North Delhi residential area, Maidens Hotel is one of Delhi’s oldest hotels, built in the early 1900s, and has retained its colonial charm and architecture. Set amidst eight acres of lush gardens, shady trees, it escapes the noise of the main city, but remains within easy access to some of the most magnificent Mughal monuments, and famous shopping center Chandni Chowk with its quaint bazaars and meandering lanes.

- Offline Retail

- Largest retailer in Asia.

- Operates 10,901 stores across 6,700+ cities with a retail area of over 24.5 million sft.

- Online Retail

- Organic New Commerce -

- Biggest online to offline retail with huge merchants base, warehousing, logistics hubs and hyperlocal services to bring together 350 Mn customer footfalls at Reliance Retail stores, 307 Mn Jio connectivity customers and 30 Mn small merchants all over India who provide the last-mile physical market connectivity. Our new commerce platform will redefine retail in India by enabling all customers ─ rich or poor, whether at home or on mobile ─ to transition from simple shopping to personalised Immersive shopping experience.

- Acquisitions for New Commerce

- Hamleys- A Hamleysin pocket will give Reliance167 stores across 18 countries. Hamleysgives RelianceRetail a global footprint.

- Urban Ladder- Foray into 750 Bn furniture retail market.

- Readymade Garment Wholesaler and Retailer.

- Rhea Retail- Portfolio of over 40 international brands that span across the luxury, bridge-to-luxury, high-premium and high-street lifestyle segments.

- GLB Body Care-

- Genesis Colors Limited GCL

- GLF Lifestyle Brands

- Genesis La Mode

- Genesis Luxury Fashion Pvt Ltd

- GML India Fashion

TMT — Technology Media & Telecommunications

- Organic

- Jio Platforms wants to bring digital services to the grassroots of this country.

- Jio Platforms is described as a next-generation technology platform focused on delivering digital services across India.

- Its proof of concept product so far has been Jio, a data-centric 4G LTE network that was launched in India in 2016 and is currently building 5G/6G stacks.

- Acquisitions

- MR/VR/AR- Company behind JIOGlass, a MR/AR/VR headset.

- High Performance Simulation- Simulate solutions to industrial problems virtually, removing the need to conduct costly physical experiments.

- Music Streaming- Combines the streaming media expertise of Saavn with the connectivity and digital ecosystem of Jio.

- Language Technologies- Real-time delivery of online content in multiple Indian languages.

- Connected Car- Provides cutting-edge technologies in AI, ML and Edge Computing to help reduce accidents by creating a new safe driving standard for commercial vehicles.

- ChatBot- ChatBot capabilities across various devices and touchpoints in the consumer’s journey.

- ShopSense- Functions via an O2O model and directly sources products across various categories — including clothing, footwear, jewellery, and accessories, from prominent brands in the country.

- EasyGov- Software-As-A-Service (SaaS) that enables citizens to search and apply for various Indian government schemes/services from a single platform.

- AgriTech — Reliance Industries (RIL) is foraying into the growing agritech business through a combination of online technology, leveraging the strength of its new partner Facebook and collaborations in farm equipment innovations as part of its move to expand its “farm to fork” model.

- Drones- To develop high quality UAV solutions and products to translate aerial view data into actionable intelligence

- Small Business Discovery- Platform that automatically structures anything a business updates on its website to ensure customers can connect directly with the business

- BlockChain- To digitise the global commodities trading industry, creating a secure, trusted ecosystem, powered by blockchain, smart contracts and machine learning.

- Mobile Operating System-

- Organic

- Largest media conglomerates with diversified but synergistic interests in Television with its bouquet of fifty channels in India and thirteen international channels, besides filmed entertainment, digital content, magazines, digital commerce and allied businesses. Network18 has built successful strategic alliances with globally reputed media players such as Viacom, CNBC, CNN, A+E Networks and Forbes.

- Acquisition

- Balaji Telefilms- TV content creation and film production company.

- Eros International- Produce and acquire Indian films and digital originals across all languages

- Organic

- JIO- Largest Telecom Company in India with 450 Million customers.

- Operates a national LTE network with coverage across all 22 telecom circles. Ready to launch 5G pan India and also preparing for 6G.

- Acquisitions

- HathWay- Digital Cable TV & Broadband Internet Service provider in India.

- DEN Networks- Cable Television Distribution.

- RadiSys- Better utilization of spectrum and accelerates the migration to next-generation standards 5G, IOT.

Education

- Organic Offline Education

- International Schools -CISCE / CIE / ICSE / IGCSE / CIPP / IB

- CBSE Schools — 13 Reliance Foundation Schools, collectively provide quality education to around 14,500 children annually and employ nearly 1000 teachers. Pan India expansions planned.

- Universities

- PDPU

- JIO University

- Acquisition Online Education

- Technology Platform Under Development- RIL acquires stake in Embibe to form India’s largest AI based education platform

Sports

- To foster team spirit and build healthy camaraderie among its employees, Reliance has sports and recreation facilities at all its sites and its corporate office. The state-of-the-art sports facilities include cricket stadiums, tennis and basketball courts and football turfs along with other indoor sport spaces.

- Cricket- Owner of Mumbai Indians the most successful cricket team in Indian Premier League.

- Reliance owns and operates the ‘Mumbai Indians’ (MI) franchise of the Indian Premier League (IPL) organised by the Board of Control for Cricket in India (BCCI). MI is among the most successful franchisees in the IPL, winning the championship in 2013, 2015, 2017, 2020.

- Badminton — Tying up with India badminton association.

- Tennis- IMG Reliance owns and operates India’s premium sporting event and South Asia’s only ATP World Tour 250 Event since 1996. The longest running ATP World Tour Event in South Asia celebrated its 20th anniversary in 2015 and moved to its new home in Pune to continue its legacy by hosting the 23rd edition — ‘Tata Open Maharashtra’.

- ISL Footbal- Promoted by IMG-Reliance and Rupert Murdoch’s Star India, Indian Super League (ISL) is India’s premier football championship that has received worldwide recognition. 173 million people watched ISL 2017–18 on TV and 1.3 million spectators attended matches across different stadia.

- BasketBall- RIL & National BasketballAssociation (NBA) are starting a professional basketballleague in India in the coming two-three years.

MICE — Meetings, incentives, conferences and exhibitions

- MICE is a type of tourism in which large groups, usually planned well in advance, are brought together.

- IMGReliance- India’s largest company Reliance Industries collaborated with IMG in a joint venture to promote and develop sports, entertainment and fashion in India.

- DAICEC- Dhirubhai Ambani International Convention and Exhibition Centre a mixed used facility with an investment of 685 Mn USD.

- JIOGardens- Jio Garden is an example of our commitment to creating world-class, multi-purpose and technology-enabled public spaces for a fast growing India.

Mobility

- Mobility As A Service- RIL aims to have an exclusive partnership with SkyTran in India to develop a rapid transport system to avoid traffic congestion and change the face of transportation in the country. It will also help alleviate the problem of pollution in India.

- Hyperlocal Delivery- From groceries to e-tailing, hyperlocal delivery specialises in on demand, first mile, last mile, on-demand, and reverse logistics.

- Acquisitions

- RRVL is a subsidiary of Reliance Industries Limited, carrying on the Consumer Supply Chain Business and Consumer Retail Business through its subsidiaries.

- Acquisitions done so far Embibe, Fynd, Grab, Haptik, Reverie, Saavn, Tesseract, Den Networks, Hathway Cable and Datacom, Hamleys, Netmeds, Asteria Aerospace, NowFloats Technologies, Radisys, Urban Ladder.

- StartUp Accelerator — JioGenNext is a startup accelerator backed by Reliance Industries. It advises and mentors exceptional founders for launching their startup in the Jio ecosystem.

Foundation — Largest with billions of CSR spend each year in following main areas of focus.